National debt of the United States

The federal government has a 6.75 to 1 debt to revenue ratio as of Q2 2023.

| This article is part of a series on the |

| Budget and debt in the United States of America |

|---|

|

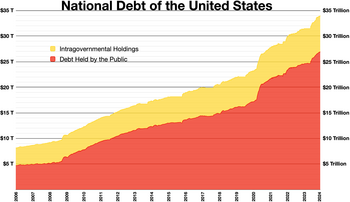

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms "national deficit" and "national surplus" usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year.[1] There are two components of gross national debt:[2]

- "Debt held by the public" – such as Treasury securities held by investors outside the federal government, including those held by individuals, corporations, the Federal Reserve, and foreign, state and local governments.

- "Debt held by government accounts" or "intragovernmental debt" – is non-marketable Treasury securities held in accounts of programs administered by the federal government, such as the Social Security Trust Fund. Debt held by government accounts represents the cumulative surpluses, including interest earnings, of various government programs that have been invested in Treasury securities.

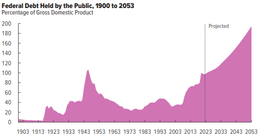

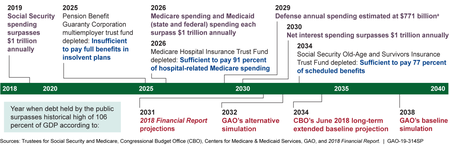

Historically, the U.S. public debt as a share of gross domestic product (GDP) increases during wars and recessions and then subsequently declines. The ratio of debt to GDP may decrease as a result of a government surplus or via growth of GDP and inflation. The Congressional Budget Office (CBO) estimated in February 2024 that Federal debt held by the public is projected to rise from 99 percent of GDP in 2024 to 116 percent in 2034, and would continue to grow if current laws generally remained unchanged. Over that period, the growth of interest costs and mandatory spending outpaces the growth of revenues and the economy, driving up debt. Those factors persist beyond 2034, pushing federal debt higher still, to 172 percent of GDP in 2054.[3] In recent decades, aging demographics and rising healthcare costs have led to concern about the long-term sustainability of the federal government's fiscal policies.[4] The aggregate, gross amount that Treasury can borrow is limited by the United States debt ceiling.[5]

During the COVID-19 pandemic, the federal government spent trillions in virus aid and economic relief. The Congressional Budget Office (CBO) estimated that the budget deficit for fiscal year 2020 would increase to $3.3 trillion or 16% GDP, more than triple that of 2019 and the largest as % GDP since 1945.[6] In December 2021, debt held by the public was estimated at 96.19% of GDP, and approximately 33% of this public debt was owned by foreigners (government and private).[7] The United States has the largest external debt in the world. The total number of U.S. Treasury securities held by foreign entities in December 2021 was $7.7 trillion, up from $7.1 trillion in December 2020.[8]

Total US federal government debt breached the $30 trillion mark for the first time in history in February 2022.[9] As of December 2023, total federal debt was $33.1 trillion; $26.5 trillion held by the public and $12.1 trillion in intragovernmental debt.[10] The annualized cost of servicing this debt was $726 billion in July 2023, which accounted for 14% of the total federal spending.[11] In February 2024, the total federal government debt grew to $34.4 trillion after having grown by approximately $1 trillion in both of two separate 100-day periods since the previous June.[12] By November 2024, the debt had grown to $36 trillion.[13][11]

History

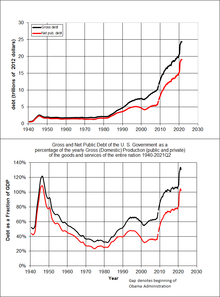

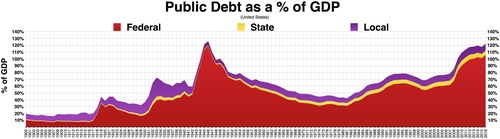

The United States federal government has continuously had a fluctuating public debt since its formation in 1789, except for about a year during 1835–1836, a period in which the nation, during the presidency of Andrew Jackson, completely paid the national debt. To allow comparisons over the years, public debt is often expressed as a ratio to GDP. The United States public debt as a percentage of GDP reached its highest level during Harry Truman's first presidential term, during and after World War II. Public debt as a percentage of GDP fell rapidly in the post-World War II period and reached a low in 1974 under Richard Nixon. Debt as a share of GDP has consistently increased since then, except during the presidencies of Jimmy Carter and Bill Clinton.

Public debt rose sharply during the 1980s, as Ronald Reagan negotiated with Congress to cut tax rates and increase military spending. It fell during the 1990s because of decreased military spending, increased taxes and the 1990s boom. Public debt rose sharply during George W. Bush's presidency and in the wake of the 2007–2008 financial crisis, with resulting significant tax revenue declines and spending increases, such as the Emergency Economic Stabilization Act of 2008 and the American Recovery and Reinvestment Act of 2009.[14]

In their September 2018 monthly report published on October 5 and based on data from the Treasury Department's "Daily Treasury Statements" (DTS), the Congressional Budget Office (CBO) wrote that the federal budget deficit was c.$782 billion for the fiscal year 2018—which runs from October 2017 through September 2018. This is $116 billion more than in FY2017.[15]: 1 The Treasury statements as summarized by in the CBO report that corporate taxes for 2017 and 2018 declined by $92 billion representing a drop of 31%. The CBO added that "about half of the decline ... occurred since June" when some of the provisions of the Tax Cuts and Jobs Act of 2017 took effect, which included the "new lower corporate tax rate and the expanded ability to immediately deduct the full value of equipment purchases". (~$1.6 trillion in 2023)[15]

According to articles in The Wall Street Journal[16] and Business Insider,[17][16][18] based on documents released on October 29, 2018, by the Treasury Department,[19] the department's projection[17] estimated that by the fourth quarter of the FY2018, it would have issued c. $1.338 trillion (~$1.6 trillion in 2023) in debt. This would have been the highest debt issuance since 2010, when it reached $1.586 trillion (~$2.16 trillion in 2023). The Treasury anticipated that the total "net marketable debt"—net marketable securities—issued in the fourth quarter would reach $425 billion; which would raise the 2018 "total debt issuance" to over a trillion dollars of new debt, representing a "146% jump from 2017".[17] According to the Journal that is the highest fourth quarter issuance "since 2008, at the height of the financial crisis."[16] As cited by the Journal and the Business Insider, the primary drivers of new debt issuance are "stagnant", "sluggish tax revenues", a decrease in "corporate tax revenue",[17] due to the GOP Tax Cuts and Jobs Act of 2017,[16] the "bipartisan budget agreement", and "higher government spending".[16][17]

Valuation and measurement

Public and government accounts

As of July 20, 2020, debt held by the public was $20.57 trillion, and intragovernmental holdings were $5.94 trillion, for a total of $26.51 trillion.[20] Debt held by the public was approximately 77% of GDP in 2017, ranked 43rd highest out of 207 countries.[21] The CBO forecast in April 2018 that the ratio will rise to nearly 100% by 2028, perhaps higher if current policies are extended beyond their scheduled expiration date.[22]

The national debt can also be classified into marketable or non-marketable securities. Most of the marketable securities are Treasury notes, bills, and bonds held by investors and governments globally. The non-marketable securities are mainly the "government account series" owed to certain government trust funds such as the Social Security Trust Fund, which represented $2.82 trillion (~$3.45 trillion in 2023) in 2017.[23]

The non-marketable securities represent amounts owed to program beneficiaries. For example, in the cash upon receipt but spent for other purposes.[sentence fragment] If the government continues to run deficits in other parts of the budget, the government will have to issue debt held by the public to fund the Social Security Trust Fund, in effect exchanging one type of debt for the other.[24][failed verification][dubious – discuss] Other large intragovernmental holders include the Federal Housing Administration, the Federal Savings and Loan Corporation's Resolution Fund and the Federal Hospital Insurance Trust Fund (Medicare).[citation needed]

Accounting treatment

Only debt held by the public is reported as a liability on the consolidated financial statements of the United States government. Debt held by US government accounts is an asset to those accounts but a liability to the Treasury; they offset each other in the consolidated financial statements.[25] Government receipts and expenditures are normally presented on a cash rather than an accrual basis, although the accrual basis may provide more information on the longer-term implications of the government's annual operations.[26] The United States public debt is often expressed as a ratio of public debt to GDP. The ratio of debt to GDP may decrease as a result of a government surplus as well as from growth of GDP and inflation.[citation needed]

Fannie Mae and Freddie Mac obligations excluded

Under normal accounting rules, fully owned companies would be consolidated into the books of their owners, but the large size of Fannie Mae and Freddie Mac has made the U.S. government reluctant to incorporate them into its own books. When the two mortgage companies required bail-outs, White House Budget Director Jim Nussle, on September 12, 2008, initially indicated their budget plans would not incorporate the government-sponsored enterprise (GSE) debt into the budget because of the temporary nature of the conservator intervention.[27] As the intervention has dragged out, pundits began to question this accounting treatment, noting that changes in August 2012 "makes them even more permanent wards of the state and turns the government's preferred stock into a permanent, perpetual kind of security".[28]

The federal government controls the Public Company Accounting Oversight Board, which would normally criticize inconsistent accounting practices, but it does not oversee its own government's accounting practices or the standards set by the Federal Accounting Standards Advisory Board. The on- or off-balance sheet obligations of those two independent GSEs was just over $5 trillion at the time the conservatorship was put in place, consisting mainly of mortgage payment guarantees and agency bonds.[29] The confusing independent but government-controlled status of the GSEs resulted in investors of the legacy common shares and preferred shares launching various activist campaigns in 2014.[30]

Guaranteed obligations excluded

U.S. federal government guarantees were not included in the public debt total as they were not drawn against.[clarification needed] In late 2008, the federal government had guaranteed large amounts of obligations of mutual funds, banks, and corporations under several programs designed to deal with the problems arising from the 2007–2008 financial crisis. The guarantee program lapsed at the end of 2012, when Congress declined to extend the scheme. The funding of direct investments made in response to the crisis, such as those made under the Troubled Asset Relief Program, was included in the debt totals.

Unfunded obligations excluded

The U.S. federal government is obligated under current law to make mandatory payments for programs such as Medicare, Medicaid and Social Security. The Government Accountability Office (GAO) projects that payouts for these programs will significantly exceed tax revenues over the next 75 years. The Medicare Part A (hospital insurance) payouts already exceed program tax revenues, and social security payouts exceeded payroll taxes in fiscal year 2010. These deficits require funding from other tax sources or borrowing.[31] The present value of these deficits or unfunded obligations is an estimated $45.8 trillion. This is the amount that would have had to be set aside in 2009 in order to pay for the unfunded obligations which, under current law, will have to be raised by the government in the future. Approximately $7.7 trillion relates to Social Security, while $38.2 trillion relates to Medicare and Medicaid. In other words, health care programs will require nearly five times more funding than Social Security. Adding this to the national debt and other federal obligations would bring total obligations to nearly $62 trillion.[32] However, these unfunded obligations are not counted in the national debt, as shown in monthly Treasury reports of the national debt.[33]

Measuring debt burden

Federal, State, and Local debt and a percentage of GDP chart/graph

GDP is a measure of the total size and output of the economy. One measure of the debt burden is its size relative to GDP, called the "debt-to-GDP ratio". Mathematically, this is the debt divided by the GDP amount. The Congressional Budget Office includes historical budget and debt tables along with its annual "Budget and Economic Outlook". Debt held by the public as a percentage of GDP rose from 34.7% GDP in 2000 to 40.5% in 2008 and 67.7% in 2011.[34] Mathematically, the ratio can decrease even while debt grows if the rate of increase in GDP (which also takes account of inflation) is higher than the rate of increase of debt. Conversely, the debt to GDP ratio can increase even while debt is being reduced, if the decline in GDP is sufficient.

According to the CIA World Factbook, during 2015, the U.S. debt to GDP ratio of 73.6% was the 39th highest in the world. This was measured using "debt held by the public."[35] However, $1 trillion in additional borrowing since the end of FY 2015 raised the ratio to 76.2% as of April 2016 [See Appendix#National debt for selected years]. Also, this number excludes state and local debt. According to the OECD, general government gross debt (federal, state, and local) in the United States in the fourth quarter of 2015 was $22.5 trillion (125% of GDP); subtracting out $5.25 trillion for intragovernmental federal debt to count only federal "debt held by the public" gives 96% of GDP.[36]

The ratio is higher if the total national debt is used, by adding the "intragovernmental debt" to the "debt held by the public." For example, on April 29, 2016, debt held by the public was approximately $13.84 trillion (~$17.2 trillion in 2023) or about 76% of GDP. Intra-governmental holdings stood at $5.35 trillion, giving a combined total public debt of $19.19 trillion. U.S. GDP for the previous 12 months was approximately $18.15 trillion, for a total debt to GDP ratio of approximately 106%.[37]

Calculating the annual change in debt

Conceptually, an annual deficit (or surplus) should represent the change in the national debt, with a deficit adding to the national debt and a surplus reducing it. However, there is complexity in the budgetary computations that can make the deficit figure commonly reported in the media (the "total deficit") considerably different from the annual increase in the debt. The major categories of differences are the treatment of the Social Security program, Treasury borrowing, and supplemental appropriations outside the budget process.[38]

Social Security payroll taxes and benefit payments, along with the net balance of the U.S. Postal Service, are considered "off-budget", while most other expenditure and receipt categories are considered "on-budget". The total federal deficit is the sum of the on-budget deficit (or surplus) and the off-budget deficit (or surplus). Since FY1960, the federal government has run on-budget deficits except for FY1999 and FY2000, and total federal deficits except in FY1969 and FY1998–FY2001.[39]

For example, in January 2009 the CBO reported that for FY2008, the "on-budget deficit" was $638 billion, offset by an "off-budget surplus" (mainly due to Social Security revenue in excess of payouts) of $183 billion, for a "total deficit" of $455 billion. This latter figure is the one commonly reported in the media. However, an additional $313 billion was required for "the Treasury actions aimed at stabilizing the financial markets," an unusually high amount because of the subprime mortgage crisis. This meant that the "debt held by the public" increased by $768 billion ($455B + $313B = $768B). The "off-budget surplus" was borrowed and spent (as is typically the case), increasing the "intra-governmental debt" by $183 billion. So the total increase in the "national debt" in FY2008 was $768B +$183B = $951 billion.[38] The Treasury Department reported an increase in the national debt of $1,017B for FY2008.[40] The $66 billion difference is likely from "supplemental appropriations" for the War on Terror, some of which were outside the budget process entirely until President Obama began including most of them in his FY2010 budget.[41]

In other words, spending the "off budget" Social Security surplus adds to the total national debt (by increasing the intragovernmental debt) while the "off-budget" surplus reduces the "total" deficit reported in the media. Certain spending called "supplemental appropriations" is outside the budget process entirely but adds to the national debt. Funding for the Iraq and Afghanistan wars was accounted for this way prior to the Obama administration.[41] Certain stimulus measures and earmarks were also outside the budget process. The federal government publishes the total debt owed (public and intragovernmental holdings) daily.[42]

Holders of debt

Because a large variety of people own the notes, bills, and bonds in the "public" portion of the debt, the Treasury also publishes information that groups the types of holders by general categories to portray who owns United States debt. In this data set, some of the public portion is moved and combined with the total government portion, because this amount is owned by the Federal Reserve as part of United States monetary policy. (See Federal Reserve System.)

As is apparent from the chart, a little less than half of the total national debt is owed to the "Federal Reserve and intragovernmental holdings". The foreign and international holders of the debt are also put together from the notes, bills, and bonds sections. To the right is a chart for the data as of June 2008:

Foreign holdings

April 2021 - April 2022

As of October 2018, foreigners owned $6.2 trillion of U.S. debt, or approximately 39% of the debt held by the public of $16.1 trillion and 28% of the total debt of $21.8 trillion.[43] In December 2020, foreigners held 33% ($7 trillion out of $21.6 trillion) of publicly held US debt; of this $7 trillion, $4.1 trillion (59.2%) belonged to foreign governments and $2.8 trillion (40.8%) to foreign investors. Including both private and public debt holders, the top three December 2020 national holders of American public debt are Japan ($1.2 trillion or 17.7%), China ($1.1 trillion or 15.2%), and the United Kingdom ($0.4 trillion or 6.2%).[44]

Historically, the share held by foreign governments had grown over time, rising from 13% of the public debt in 1988[45] to 34% in 2015.[46] In more recent years, foreign ownership has retreated both in percent of total debt and total dollar amounts. China's maximum holding of 9.1% or $1.3 trillion of U.S. debt occurred in 2011, subsequently reduced to 5% in 2018. Japan's maximum holding of 7% or $1.2 trillion occurred in 2012, subsequently reduced to 4% in 2018.[47]

According to Paul Krugman, "America actually earns more from its assets abroad than it pays to foreign investors."[48] Nonetheless, the country's net international investment position represents a debt of more than $9 trillion.[49]

Forecast

CBO ten-year outlook 2018–2028 (pre–COVID-19 pandemic)

The CBO estimated the impact of the Tax Cuts and Jobs Act and separate spending legislation over the 2018–2028 period in their annual "Budget & Economic Outlook", released in April 2018:

- The budget deficit in fiscal 2018 (which runs from October 1, 2017, to September 30, 2018, the first year budgeted by President Trump) is forecast to be $804 billion, an increase of $139 billion (21%) from the $665 billion in 2017 and up $242 billion (39%) over the previous baseline forecast (June 2017) of $580 billion for 2018. The June 2017 forecast was essentially the budget trajectory inherited from President Obama; it was prepared prior to the Tax Act and spending increases under President Trump.

- For the 2018–2027 period, CBO projects the sum of the annual deficits (i.e., debt increase) to be $11.7 trillion, an increase of $1.6 trillion (16%) over the previous baseline (June 2017) forecast of $10.1 trillion.

- The $1.6 trillion debt increase includes three main elements:

- $1.7 trillion less in revenues due to the tax cuts;

- $1.0 trillion more in spending; and

- Partially offsetting incremental revenue of $1.1 trillion due to higher economic growth than previously forecast.

- Debt held by the public is expected (Congressional Budget Office Outlook) to rise from 78% of GDP ($16 trillion) at the end of 2018 to 96% GDP ($29 trillion) by 2028. That would be the highest level since the end of World War II.[citation needed]

- CBO estimated under an alternative scenario (in which policies in place as of April 2018 are maintained beyond scheduled initiation or expiration) that deficits would be considerably higher, rising by $13.7 trillion over the 2018–2027 period, an increase of $3.6 trillion over the June 2017 baseline forecast. Maintaining current policies for example would include extending the individual Trump tax cuts past their scheduled expiration in 2025, among other changes.

- The debt increase of $1.6 trillion represents approximately $12,700 per household (assuming 126.2 million households in 2017), while the $3.6 trillion represents $28,500 per household.[22]

CBO ten-year outlook 2020–2030 (during the COVID-19 pandemic)

The CBO estimated that the budget deficit for fiscal year 2020 would increase to $3.3 trillion or 16% GDP, more than triple that of 2019 and the largest as % GDP since 1945, because of the impact of the COVID-19 pandemic. CBO also forecast the debt held by the public would rise to 98% GDP in 2020, compared with 79% in 2019 and 35% in 2007 before the Great Recession.[6]

CBO long-term outlook

The CBO reports its Long-Term Budget Outlook annually, providing at least two scenarios for spending, revenue, deficits, and debt. The 2019 Outlook mainly covers the 30-year period through 2049. The CBO reported:

Large budget deficits over the next 30 years are projected to drive federal debt held by the public to unprecedented levels—from 78 percent of gross domestic product (GDP) in 2019 to 144 percent by 2049. That projection incorporates CBO's central estimates of various factors, such as productivity growth and interest rates on federal debt. CBO's analysis indicates that even if values for those factors differed from the agency's projections, debt several decades from now would probably be much higher than it is today.[50]

Furthermore, under alternative scenarios:

If lawmakers changed current laws to maintain certain major policies now in place—most significantly, if they prevented a cut in discretionary spending in 2020 and an increase in individual income taxes in 2026—then debt held by the public would increase even more, reaching 219 percent of GDP by 2049. By contrast, if Social Security benefits were limited to the amounts payable from revenues received by the Social Security trust funds, debt in 2049 would reach 106 percent of GDP, still well above its current level.

Over the long-term, the CBO projects that interest expense and mandatory spending categories (e.g., Medicare, Medicaid and Social Security) will continue to grow relative to GDP, while discretionary categories (e.g., Defense and other Cabinet Departments) continue to fall relative to GDP. Debt is projected to continue rising relative to GDP under the above two scenarios, although the CBO did also offer other scenarios that involved austerity measures that would bring the debt to GDP ratio down.[50]

Ways to reduce debt

Negative real interest rates

Since 2010, the U.S. Treasury has been obtaining negative real interest rates on government debt, meaning the inflation rate is greater than the interest rate paid on the debt.[51] Such low rates, outpaced by the inflation rate, occur when the market believes that there are no alternatives with sufficiently low risk, or when popular institutional investments such as insurance companies, pensions, or bond, money market, and balanced mutual funds are required or choose to invest sufficiently large sums in Treasury securities to hedge against risk.[52][53] Economist Lawrence Summers states that at such low interest rates, government borrowing actually saves taxpayer money and improves creditworthiness.[54]

In the late 1940s through the early 1970s, the U.S. and UK both reduced their debt burden by about 30% to 40% of GDP per decade by taking advantage of negative real interest rates, but there is no guarantee that government debt rates will continue to stay this low.[52][55] Between 1946 and 1974, the U.S. debt-to-GDP ratio fell from 121% to 32% even though there were surpluses in only eight of those years which were much smaller than the deficits.[56]

Raising reserve requirements and full reserve banking

Two economists, Jaromir Benes and Michael Kumhof, working for the International Monetary Fund, published a working paper called The Chicago Plan Revisited suggesting that the debt could be eliminated by raising bank reserve requirements and converting from fractional-reserve banking to full-reserve banking.[57][58] Economists at the Paris School of Economics have commented on the plan, stating that it is already the status quo for coinage currency,[59] and a Norges Bank economist has examined the proposal in the context of considering the finance industry as part of the real economy.[60] A Centre for Economic Policy Research paper agrees with the conclusion that "no real liability is created by new fiat money creation and therefore public debt does not rise as a result."[61]

Risks and debates

CBO risk factors

The CBO reported several types of risk factors related to rising debt levels in a July 2010 publication:

- A growing portion of savings would go towards purchases of government debt, rather than investments in productive capital goods such as factories and computers, leading to lower output and incomes than would otherwise occur;

- If higher marginal tax rates were used to pay rising interest costs, savings would be reduced and work would be discouraged;

- Rising interest costs would force reductions in government programs;

- Restrictions to the ability of policymakers to use fiscal policy to respond to economic challenges; and

- An increased risk of a sudden fiscal crisis, in which investors demand higher interest rates.[62]

Credit default

The U.S. has never fully defaulted.[63][64] In April 1979, however, the U.S. may have technically defaulted on $122 million (~$413 million in 2023) in Treasury bills, which was less than 1% of U.S. debt. The Treasury Department characterized it as a delay rather than as a default, but it did have consequences for short-term interest rates, which jumped 0.6%.[65] Others view it as a temporary, partial default.[66][67][68]

Debt ceiling

The United States debt ceiling is a legislative constraint on the amount of national debt that can be incurred by the U.S. Treasury. It limits how much money the federal government may pay on the debt it already has by borrowing even more money. The debt ceiling applies to almost all federal debt, including accounts owned by the public and intra-government funds for Medicare and Social Security.[69][70]

Sustainability

In 2009 the Government Accountability Office (GAO) reported that the United States was on a "fiscally unsustainable" path because of projected future increases in Medicare and Social Security spending.[31] According to the Treasury report in October 2018, summarized by Business Insider's Bob Bryan, the U.S. federal budget deficit rose as a result of the Tax Cuts and Jobs Act of 2017[16] signed into law by President Donald Trump on December 22, 2017[71] and the Consolidated Appropriations Act, 2018 signed into law on March 23, 2018.[72][73]

Risks to economic growth

Debt levels may affect economic growth rates. In 2010, economists Kenneth Rogoff and Carmen Reinhart reported that among the 20 developed countries studied, average annual GDP growth was 3–4% when debt was relatively moderate or low (i.e., under 60% of GDP), but it dips to just 1.6% when debt was high (i.e., above 90% of GDP).[74] In April 2013, the conclusions of Rogoff and Reinhart's study came into question when a coding error in their original paper was discovered by Herndon, Ash and Pollin of the University of Massachusetts Amherst.[75][76] Herndon, Ash and Pollin found that after correcting for errors and unorthodox methods used, there was no evidence that debt above a specific threshold reduces growth.[77] Reinhart and Rogoff maintain that after correcting for errors, a negative relationship between high debt and growth remains.[78] However, other economists, including Paul Krugman, have argued that it is low growth which causes national debt to increase, rather than the other way around.[79][80][81]

Commenting on fiscal sustainability, former Federal Reserve Chairman Ben Bernanke stated in April 2010 that "Neither experience nor economic theory clearly indicates the threshold at which government debt begins to endanger prosperity and economic stability. But given the significant costs and risks associated with a rapidly rising federal debt, our nation should soon put in place a credible plan for reducing deficits to sustainable levels over time."[82]

Interest and debt service costs

Interest expense on the public debt was approximately $678 billion in FY2023. During FY2023, the government also accrued a non-cash interest expense of $197 billion for intra-governmental debt, primarily the Social Security Trust Fund, for a total interest expense of $875 billion. This accrued interest is added to the Social Security Trust Fund and therefore the national debt each year and will be paid to Social Security recipients in the future. However, since it is a non-cash expense it is excluded from the budget deficit calculation.[83]

The federal debt at the end of the 2018/19 fiscal year (ended September 30, 2019) was $22.7 trillion (~$27.1 trillion in 2023). The portion that is held by the public was $16.8 trillion. Neither figure includes approximately $2.5 trillion owed to the government.[84] Interest on the debt was $404 billion.[85]

The cost of servicing the U.S. national debt can be measured in various ways. The CBO analyzes net interest as a percentage of GDP, with a higher percentage indicating a higher interest payment burden. During 2015, this was 1.3% GDP, close to the record low 1.2% of the 1966–1968 era. The average from 1966 to 2015 was 2.0% of GDP.[86] However, the CBO estimated in 2016 that the interest amounts and % GDP will increase significantly over the following decade as both interest rates and debt levels rise: "Interest payments on that debt represent a large and rapidly growing expense of the federal government. CBO's baseline shows net interest payments more than tripling under current law, climbing from $231 billion in 2014, or 1.3% of GDP, to $799 billion in 2024, or 3.0% of GDP—the highest ratio since 1996."[87]

According to a study by the Committee for a Responsible Federal Budget (CRFB), the U.S. government will spend more on servicing their debts than they do for their national defense budget by 2024.[88]

In October 2023, yields for 10-year Treasury notes breached 5% as traders adjusted their assessment of United States' fiscal position and lowered their expectation that Congress or the White House would take any action to improve it. The impact was felt by homebuyers, with 30-year mortgage rate at its highest in two decades, and corporations facing higher costs of borrowing. Interests paid by the federal government jumped by $184 billion during the 2022 fiscal year and are still climbing.[89]

Recent US debt service/interest statistics

| FY | GAO: (Total) Debt Service (in billion dollars) | FRED: (Total) Debt Service (in billion dollars)[1] | GAO: (Publicly-held) Debt Service (in billion dollars) | FRED: Fed Receipts (in billion dollars)[2] | FRED: Debt Service/Receipts |

|---|---|---|---|---|---|

| 2023 | 875.5[90] | 981[91] | 678[90] | 4439 | 22% |

| 2022 | 723.6[90] | 829.6 | 496.5[90] | 4896 | 17% |

| 2021 | 575[92] | 612 | 392[93] | 4047 | 15% |

| 2020 | 527[93] | 517.7 | 371[93][94] | 3421 | 15% |

| 2019 | 574[94] | 564.5 | 404[94] | 3463 | 16% |

| 2018 | 528.4[95] | 571 | 357[95] | 3330 | 17% |

| 2017 | 456.7[95] | 493 | 296[95] | 3316 | 15% |

| 2016 | 430[96] | 460 | 273[96] | 3268 | 14% |

| 2015 | 407[96] | 434.7 | 251[96] | 3250 | 13% |

| 2014 | 433[97] | 442 | 260[97] | 3021 | 15% |

| 2013 | 425[97] | 425 | 247.6[97] | 2775 | 15% |

| 2012 | 432[98] | 417 | 245.4[98] | 2450 | 17% |

| 2011 | 453.6[98] | 433 | 250.9[98] | 2303 | 19% |

| 2010 | 413[99] | 399.5 | 215[99] | 2162.7 | 18% |

| 2009 | 380.7[99] | 353.8 | 189[99] | 2105 | 17% |

Chinese holdings of U.S. debt

According to a 2013 Forbes article, many American and other economic analysts have expressed concerns on the amount of United States government debt the People's Republic of China is holding as part of their reserves.[100][101] The National Defense Authorization Act of FY2012 included a provision requiring the Secretary of Defense to conduct a "national security risk assessment of U.S. federal debt held by China." The department issued its report in July 2012, stating that "attempting to use U.S. Treasury securities as a coercive tool would have limited effect and likely would do more harm to China than to the United States.” [citation needed] An August 19, 2013 Congressional Research Service report said that the threat is not credible and the effect would be limited even if carried out. The report said that the threat would not offer "China deterrence options, whether in the diplomatic, military, or economic realms, and this would remain true both in peacetime and in scenarios of crisis or war."[102]

A 2010 article by James K. Galbraith in The Nation, defends deficits and dismisses concerns over foreign holdings of United States government debt denominated in U.S. dollars, including China's holdings.[103] In 2010, Warren Mosler, wrote that "When[ever] the Chinese redeem those T-securities, the money is transferred back to China's checking account at the Fed. During the entire purchase and redemption process, the dollars never leave the Fed."[104] Australian economist Bill Mitchell argued that the United States government had a "nearly infinite capacity...to spend."[105] Against the backdrop of escalating Sino-U.S. tensions in 2020, Yuzo Sakai, a manager at Ueda Totan Forex Ltd., said that if China undertakes a massive sales of U.S. bonds, investors may flock to the Japanese yen as a safe-haven currency. Since 2018, China had been gradually decreasing its holdings of U.S. federal debt, bringing the total to $1.07 trillion in June 2020, behind Japan who became the biggest foreign creditor of the United States. Stephen Nagy, a professor at the International Christian University, said a sell-off by China "might damage the United States in the short term" but also cause "critical economic instability" in the Chinese and global economy. Jeff Kingston, a professor and director of Asian Studies at Temple University, Japan, echoed the view, adding that dumping would lower the price of U.S. bonds, making it more attractive to other countries. According to an institutional investor, however, it may be difficult for Japan to boost its already large holdings of U.S. government debt, as such a move could be seen as "currency manipulation".[106]

Definition of public debt

Economists also debate the definition of public debt. Krugman argued in May 2010 that the debt held by the public is the right measure to use, while Reinhart has testified to the President's Fiscal Reform Commission that gross debt is the appropriate measure.[79] The Center on Budget and Policy Priorities (CBPP) cited research by several economists supporting the use of the lower debt held by the public figure as a more accurate measure of the debt burden, disagreeing with these Commission members.[107]

There is debate regarding the economic nature of the intragovernmental debt, which was approximately $4.6 trillion in February 2011.[108] For example, the CBPP argues: that "large increases in [debt held by the public] can also push up interest rates and increase the amount of future interest payments the federal government must make to lenders outside of the United States, which reduces Americans' income. By contrast, intragovernmental debt (the other component of the gross debt) has no such effects because it is simply money the federal government owes (and pays interest on) to itself."[107] However, if the U.S. government continues to run "on budget" deficits as projected by the CBO and OMB for the foreseeable future, it will have to issue marketable Treasury bills and bonds (i.e., debt held by the public) to pay for the projected shortfall in the Social Security program. This will result in "debt held by the public" replacing "intragovernmental debt".[109][110]

Intergenerational equity

One debate about the national debt relates to intergenerational equity. For example, if one generation is receiving the benefit of government programs or employment enabled by deficit spending and debt accumulation, to what extent does the resulting higher debt impose risks and costs on future generations? There are several factors to consider:

- For every dollar of debt held by the public, there is a government obligation (generally marketable Treasury securities) counted as an asset by investors. Future generations benefit to the extent these assets are passed on to them.[111]

- As of 2010, approximately 72% of the financial assets were held by the wealthiest 5% of the population.[112] This presents a wealth and income distribution question, as only a fraction of the people in future generations will receive principal or interest from investments related to the debt incurred today.

- To the extent the U.S. debt is owed to foreign investors (approximately half the "debt held by the public" during 2012), principal and interest are not directly received by U.S. heirs.[111]

- Higher debt levels imply higher interest payments, which create costs for future taxpayers (e.g., higher taxes, lower government benefits, higher inflation, or increased risk of fiscal crisis).[62]

- To the extent the borrowed funds are invested today to improve the long-term productivity of the economy and its workers, such as via useful infrastructure projects or education, future generations may benefit.[113]

- For every dollar of intragovernmental debt, there is an obligation to specific program recipients, generally non-marketable securities such as those held in the Social Security Trust Fund. Adjustments that reduce future deficits in these programs may also apply costs to future generations, via higher taxes or lower program spending.[citation needed]

Krugman wrote in March 2013 that by neglecting public investment and failing to create jobs, we are doing far more harm to future generations than merely passing along debt: "Fiscal policy is, indeed, a moral issue, and we should be ashamed of what we're doing to the next generation's economic prospects. But our sin involves investing too little, not borrowing too much." Young workers face high unemployment and studies have shown their income may lag throughout their careers as a result. Teacher jobs have been cut, which could affect the quality of education and competitiveness of younger Americans.[114]

COVID-19 pandemic and aftermath

The COVID-19 pandemic in the United States impacted the economy significantly beginning in March 2020, as businesses were shut-down and furloughed or fired personnel. About 16 million persons filed for unemployment insurance in the three weeks ending April 9. It caused the number of unemployed persons to increase significantly, which is expected to reduce tax revenues while increasing automatic stabilizer spending for unemployment insurance and nutritional support. As a result of the adverse economic impact, both state and federal budget deficits will dramatically increase, even before considering any new legislation.[115]

To help address lost income for millions of workers and assist businesses, Congress and President Trump enacted the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) on March 27, 2020. It included loans and grants for businesses, along with direct payments to individuals and additional funding for unemployment insurance. The act carried an estimated $2.3 trillion price tag, with an expectation that some or all of the loans would ultimately be paid back including interest. While the law would have almost certainly increased budget deficits relative to the January 2020 10-year CBO baseline (completed prior to the COVID-19 pandemic), in the absence of the legislation, a complete economic collapse could have occurred.[116] However, as of 2023, many of these loans have been forgiven.[117]

CBO provided a preliminary score for the CARES Act on April 16, 2020, estimating that it would increase federal deficits by about $1.8 trillion over the 2020-2030 period. The estimate includes:

- A $988 billion increase in mandatory outlays;

- A $446 billion decrease in revenues; and

- A $326 billion increase in discretionary outlays, stemming from emergency supplemental appropriations.

CBO reported that not all parts of the bill will increase deficits: “Although the act provides financial assistance totaling more than $2 trillion, the projected cost is less than that because some of that assistance is in the form of loan guarantees, which are not estimated to have a net effect on the budget. In particular, the act authorizes the Secretary of the Treasury to provide up to $454 billion to fund emergency lending facilities established by the Board of Governors of the Federal Reserve System. Because the income and costs stemming from that lending are expected to roughly offset each other, CBO estimates no deficit effect from that provision.”[118]

The Committee for a Responsible Federal Budget estimated that the budget deficit for fiscal year 2020 would increase to a record $3.8 trillion (~$4.41 trillion in 2023), or 18.7% GDP.[119] For scale, in 2009 the budget deficit reached 9.8% GDP ($1.4 trillion nominal dollars) in the depths of the Great Recession. CBO forecast in January 2020 that the budget deficit in FY2020 would be $1.0 trillion (~$1.16 trillion in 2023), prior to considering the impact of the COVID-19 pandemic or CARES.[120] CFRB further estimated that the national debt would reach 106% of U.S. GDP in September 2020, a record since the aftermath of World War II.[121]

President Biden also allocated significant amounts of money towards relief of the COVID-19 pandemic. According to a May 2021 report, Biden has or plans to spend $5.72 (~$6.35 trillion in 2023) trillion dollars toward this effort and others such as climate change including providing stimulus checks and serving schools and low-income children.[122] Many economists have agreed that this unprecedented level of spending from the Biden Administration has, in part, contributed to the inflation spike from 2021 to 2022 as a result of increasing the money supply in the economy.[123][124]

Appendix

National debt for selected years

| Fiscal year | Total debt, $Bln[125][126][127] |

Total debt as % of GDP |

Public debt, $Bln, 1996– |

Public debt as % of GDP |

GDP, $Bln, BEA/OMB[128] |

|---|---|---|---|---|---|

| 1910 | 2.65/- | 8.1% | 2.65 | 8.1% | est. 32.8 |

| 1920 | 25.95/- | 29.2% | 25.95 | 29.2% | est. 88.6 |

| 1927 | [129] 18.51/- | 19.2% | 18.51 | 19.2% | est. 96.5 |

| 1930 | 16.19/- | 16.6% | 16.19 | 16.6% | est. 97.4 |

| 1940 | 42.97/50.70 | 43.8–51.6% | 42.77 | 43.6% | -/98.2 |

| 1950 | 257.3/256.9 | 92.0% | 219.00 | 78.4% | 279.0 |

| 1960 | 286.3/290.5 | 53.6–54.2% | 236.80 | 44.3% | 535.1 |

| 1970 | 370.9/380.9 | 35.0–36.0% | 283.20 | 27.0% | 1,061 |

| 1980 | 907.7/909.0 | 32.4–32.6% | 711.90 | 25.5% | 2,792 |

| 1990 | 3,233/3,206 | 54.4–54.8% | 2,400 | 40.8% | 5,899 |

| 2000 | a15,659 | a 55.9% | a 3,450 | 33.9% | 10,150 |

| 2001 | a2 5,792 | a 55.0% | a 3,350 | 31.6% | 10,550 |

| 2002 | a3 6,213 | a 57.4% | a 3,550 | 32.7% | 10,800 |

| 2003 | a 6,783 | a 60.1% | a 3,900 | 34.6% | 11,300 |

| 2004 | a 7,379 | a 61.3% | a 4,300 | 35.6% | 12,050 |

| 2005 | a4 7,918 | a 61.7% | a 4,600 | 35.7% | 12,850 |

| 2006 | a5 8,493 | a 62.3% | a 4,850 | 35.4% | 13,650 |

| 2007 | a6 8,993 | a 62.9% | a 5,050 | 35.3% | 14,300 |

| 2008 | a7 10,011 | a 67.7% | a 5,800 | 39.4% | 14,800 |

| 2009 | a8 11,898 | a 82.2% | a 7,550 | 52.4% | 14,450 |

| 2010 | a9 13,551 | a 91.0% | a 9,000 | 61.0% | 14,900 |

| 2011 | a10 14,781 | a 95.6% | a 10,150 | 65.8% | 15,450 |

| 2012 | a11 16,059 | a 99.7% | a 11,250 | 70.3% | 16,100 |

| 2013 | a12 16,732 | a 100.4% | a 12,000 | 16,650 | |

| 2014 | a13 17,810 | a 102.5% | a 12,800 | 17,350 | |

| 2015 | a14 18,138 | a 100.3% | [130] 13,124 | 18,100 | |

| 2016 | a15 19,560 | a105.5% | [130] 14,173 | 18,550 | |

| 2017 | a16 20,233 | a105.1% | [130] 14,673 | 19,250 | |

| 2018 | a17 21,506 | a106.0% | [130] 15,761 | 20,300 | |

| 2019 | a18 22,711 | a107.4% | [130] 16,809 | 21,150 | |

| 2020 | 26,938 | 128.0% | 21,050 | ||

| 2021 Oct. '20 – Jun '21 only |

28,529 | 130.6% | 21,850 |

On July 27, 2018, the BEA revised its GDP figures in a comprehensive update and figures back to FY2013 were revised accordingly.[131]

On June 25, 2014, the BEA announced: "[On July 30, 2014, i]n addition to the regular revision of estimates for the most recent 3 years and for the first quarter of 2014, GDP and select components will be revised back to the first quarter of 1999.

Fiscal years 1940–2009 GDP figures were derived from February 2011 Office of Management and Budget figures which contained revisions of prior year figures due to significant changes from prior GDP measurements. Fiscal years 1950–2010 GDP measurements were derived from December 2010 Bureau of Economic Analysis figures which also tend to be subject to revision, especially more recent years. Afterwards the OMB figures were revised back to 2004 and the BEA figures (in a revision dated July 31, 2013) were revised back to 1947.

Regarding estimates recorded in the GDP column (the last column) marked with a "~" symbol, absolute differences from advance (one month after) BEA reports of GDP percent change to current findings (as of November 2013) found in revisions are stated to be 1.3% ± 2.0% or a 95% probability of being within the range of 0.0–3.3%, assuming the differences to occur according to standard deviations from the average absolute difference of 1.3%. E.g. with an advance report of a $400 billion increase of a $10 trillion GDP, for example, one could be 95% confident that the range in which the exact GDP dollar amount lies would be 0.0 to 3.3% different than 4.0% (400 ÷ 10,000) or within the range of $0 to $330 billion different than the hypothetical $400 billion (a range of $70–730 billion). Two months after, with a revised value, the range of potential difference from the stated estimate shrinks, and three months after with another revised value the range shrinks again.

Fiscal years 1940–1970 begin July 1 of the previous year (for example, Fiscal Year 1940 begins July 1, 1939, and ends June 30, 1940); fiscal years 1980–2010 begin October 1 of the previous year. Intragovernmental debts before the Social Security Act are presumed to equal zero.

1909–1930 calendar year GDP estimates are from MeasuringWorth.com[132] Fiscal Year estimates are derived from simple linear interpolation.

(a1) Audited figure was "about $5,659 billion."[133]

(a2) Audited figure was "about $5,792 billion."[134]

(a3) Audited figure was "about $6,213 billion."[134]

(a) Audited figure was said to be "about" the stated figure.[135]

(a4) Audited figure was "about $7,918 billion."[136]

(a5) Audited figure was "about $8,493 billion."[136]

(a6) Audited figure was "about $8,993 billion."[137]

(a7) Audited figure was "about $10,011 billion."[137]

(a8) Audited figure was "about $11,898 billion."[138]

(a9) Audited figure was "about $13,551 billion."[139]

(a10) GAO affirmed Bureau of the Public debt figure as $14,781 billion.[140]

(a11) GAO affirmed Bureau of the Public debt figure as $16,059 billion.[140]

(a12) GAO affirmed Bureau of the Fiscal Service's figure as $16,732 billion.[141]

(a13) GAO affirmed Bureau of the Fiscal Service's figure as $17,810 billion.[142]

(a14) GAO affirmed Bureau of the Fiscal Service's figure as $18,138 billion.[143]

(a15) GAO affirmed Bureau of the Fiscal Service's figure as $19,560 billion.[144]

(a16) GAO affirmed Bureau of the Fiscal Service's figure as $20,233 billion.[145]

(a17) GAO affirmed Bureau of the Fiscal Service's figure as $21,506 billion.[146]

(a18) GAO affirmed Bureau of the Fiscal Service's figure as $22,711 billion.[130]Interest paid

According to federal government data, interest payment on debt has crossed above one trillion on October 1, 2023.[147]

Note that this is all interest the U.S. paid, including interest credited to Social Security and other government trust funds, not just "interest on debt" frequently cited elsewhere.

Quarterly data annualized

| Fiscal Year |

Historical debt outstanding, $billions, US[148] |

Interest paid $billions, US[149] |

Interest rate |

| 2019 | 22,719 | 574.6 | 2.53% |

| 2018 | 21,516 | 523.0 | 2.43% |

| 2017 | 20,244 | 458.5 | 2.26% |

| 2016 | 19,573 | 432.6 | 2.21% |

| 2015 | 18,150 | 402.4 | 2.22% |

| 2014 | 17,824 | 430.8 | 2.42% |

| 2013 | 16,738 | 415.7 | 2.48% |

| 2012 | 16,066 | 359.8 | 2.24% |

| 2011 | 14,790 | 454.4 | 3.07% |

| 2010 | 13,562 | 414.0 | 3.05% |

| 2009 | 11,910 | 383.1 | 3.22% |

| 2008 | 10,025 | 451.2 | 4.50% |

| 2007 | 9,008 | 430.0 | 4.77% |

| 2006 | 8,507 | 405.9 | 4.77% |

| 2005 | 7,933 | 352.4 | 4.44% |

| 2004 | 7,379 | 321.6 | 4.36% |

| 2003 | 6,783 | 318.1 | 4.69% |

| 2002 | 6,228 | 332.5 | 5.34% |

| 2001 | 5,807 | 359.5 | 6.19% |

| 2000 | 5,674 | 362.0 | 6.38% |

| 1999 | 5,656 | 353.5 | 6.25% |

| 1998 | 5,526 | 363.8 | 6.58% |

| 1997 | 5,413 | 355.8 | 6.57% |

| 1996 | 5,225 | 344.0 | 6.58% |

| 1995 | 4,974 | 332.4 | 6.68% |

| 1994 | 4,693 | 296.3 | 6.31% |

| 1993 | 4,411 | 292.5 | 6.63% |

| 1992 | 4,065 | 292.4 | 7.19% |

| 1991 | 3,665 | 286.0 | 7.80% |

Foreign holders of U.S. Treasury securities

The following is a list of the top foreign holders of Treasury securities as listed by the Federal Reserve Board (revised by October 2024 survey):[150]

| Leading foreign holders of U.S. Treasury securities as of October 2024 | ||

|---|---|---|

| Country or region | Billions of dollars (est.) |

% change since October 2023 |

1,102.7 |

+0.4% | |

760.1 |

− 1% | |

746.0 |

+18% | |

420.0 |

+22% | |

409.1 |

+26% | |

365.7 |

+30% | |

349.6 |

+22% | |

332.9 |

+11% | |

330.1 |

+48% | |

300.4 |

+ 9% | |

285.0 |

+23% | |

250.4 |

+31% | |

248.3 |

+25% | |

241.6 |

+ 9% | |

228.8 |

+ 4% | |

| other | 2,224.8 |

+18% |

Total |

8,595.5 |

+15% |

Statistics

- U.S. official gold reserves as of 31 July 2014 total 261.5 million troy ounces with a book value of approximately $11.04 billion.[151]

- Foreign exchange reserves $140 billion as of September 2014.[152]

United States balance of trade (from 1960), with negative numbers denoting a trade deficit - The national debt was up to $80,885 per person as of 2020.[153]

- The national debt equated to $59,143 per person U.S. population, or $159,759 per member of the U.S. working taxpayers, back in March 2016.[154]

- In 2008, $242 billion was spent on interest payments servicing the debt, out of a total tax revenue of $2.5 trillion, or 9.6%. Including non-cash interest accrued primarily for Social Security, interest was $454 billion or 18% of tax revenue.[137]

- Total U.S. household debt, including mortgage loan and consumer debt, was $11.4 trillion in 2005. By comparison, total U.S. household assets, including real estate, equipment, and financial instruments such as mutual funds, was $62.5 trillion in 2005.[155]

- Total U.S. Consumer Credit Card revolving credit was $931.0 billion in April 2009.[156]

- The U.S. balance of trade deficit in goods and services was $725.8 billion in 2005.[157]

- According to the U.S. Department of Treasury Preliminary 2014 Annual Report on U.S. Holdings of Foreign Securities, the United States valued its foreign treasury securities portfolio at $2.7 trillion. The largest debtors are Canada, the United Kingdom, Cayman Islands, and Australia, whom account for $1.2 trillion of sovereign debt owed to residents of the U.S.[158]

- The entire public debt in 1998 was equal to the cost of research, development, and deployment of U.S. nuclear weapons and nuclear weapons-related programs during the Cold War.[159][160][161]

A 1998 Brookings Institution study published by the Nuclear Weapons Cost Study Committee (formed in 1993 by the W. Alton Jones Foundation), calculated that total expenditures for U.S. nuclear weapons from 1940 to 1998 was $5.5 trillion in 1996 Dollars.[159] The total public debt at the end of fiscal year 1998 was $5,478,189,000,000 in 1998 Dollars[162] or $5.3 trillion in 1996 Dollars.

International debt comparisons

| Entity | 2007 | 2010 | 2011 | 2017/2018 |

|---|---|---|---|---|

| United States | 62% | 92% | 102% | 108% |

| European Union | 59% | 80% | 83% | 82% |

| Austria | 62% | 78% | 72% | 78% |

| France | 64% | 82% | 86% | 97% |

| Germany | 65% | 82% | 81% | 64% |

| Sweden | 40% | 39% | 38% | 41% |

| Finland | 35% | 48% | 49% | 61% |

| Greece | 104% | 123% | 165% | 179% |

| Romania | 13% | 31% | 33% | 35% |

| Bulgaria | 17% | 16% | 16% | 25% |

| Czech Republic | 28% | 38% | 41% | 35% |

| Italy | 112% | 119% | 120% | 132% |

| Netherlands | 52% | 77% | 65% | 57% |

| Poland | 51% | 55% | 56% | 51% |

| Spain | 42% | 68% | 68% | 98% |

| United Kingdom | 47% | 80% | 86% | 88% |

| Japan | 167% | 197% | 204% | 236% |

| Russia | 9% | 12% | 10% | 19% |

| Asia 1 (2017+)2 | 37% | 40% | 41% | 80% |

Sources: Eurostat,[163] International Monetary Fund, World Economic Outlook (emerging market economies); Organisation for Economic Co-operation and Development, Economic Outlook (advanced economies),[164] IMF[165]

1China, Hong Kong, India, Indonesia, Korea, Malaysia, the Philippines, Singapore and Thailand 2Afghanistan, Armenia, Australia, Azerbaijan, Bangladesh, Bhutan, Brunei Darussalam, Cambodia, China, People's Republic of, Fiji, Georgia, Hong Kong SAR, India, Indonesia, Japan, Kazakhstan, Kiribati, Korea, Republic of, Kyrgyz Republic, Lao P.D.R., Macao SAR, Malaysia, Maldives, Marshall Islands, Micronesia, Fed. States of, Mongolia, Myanmar, Nauru, Nepal, New Zealand, Pakistan, Palau, Papua New Guinea, Philippines, Samoa, Singapore, Solomon Islands, Sri Lanka, Taiwan, Tajikistan, Thailand, Timor-Leste, Tonga, Turkey, Turkmenistan, Tuvalu, Uzbekistan, Vanuatu, Vietnam

Recent additions to the public debt of the United States

| Fiscal year (begins Oct. 1 of year prior to stated year) |

GDP $Billions |

New debt for fiscal year $Billions |

New debt as % of GDP |

Total debt $Billions |

Total debt as % of GDP (Debt to GDP ratio) |

|---|---|---|---|---|---|

| 1994 | 7,200 | 281–292 | 3.9–4.1% | ~4,650 | 64.6–65.2% |

| 1995 | 7,600 | 277–281 | 3.7% | ~4,950 | 64.8–65.6% |

| 1996 | 8,000 | 251–260 | 3.1–3.3% | ~5,200 | 65.0–65.4% |

| 1997 | 8,500 | 188 | 2.2% | ~5,400 | 63.2–63.8% |

| 1998 | 8,950 | 109–113 | 1.2–1.3% | ~5,500 | 61.2–61.8% |

| 1999 | 9,500 | 127–130 | 1.3–1.4% | 5,656 | 59.3% |

| 2000 | 10,150 | 18 | 0.2% | 5,674 | 55.8% |

| 2001 | 10,550 | 133 | 1.3% | 5,792 | 54.8% |

| 2002 | 10,900 | 421 | 3.9% | 6,213 | 57.1% |

| 2003 | 11,350 | 570 | 5.0% | 6,783 | 59.9% |

| 2004 | 12,100 | 596 | 4.9% | 7,379 | 61.0% |

| 2005 | 12,900 | 539 | 4.2% | 7,918 | 61.4% |

| 2006 | 13,700 | 575 | 4.2% | 8,493 | 62.1% |

| 2007 | 14,300 | 500 | 3.5% | 8,993 | 62.8% |

| 2008 | 14,750 | 1,018 | 6.9% | 10,011 | 67.9% |

| 2009 | 14,400 | 1,887 | 13.1% | 11,898 | 82.5% |

| 2010 | 14,800 | 1,653 | 11.2% | 13,551 | 91.6% |

| 2011[167] | 15,400 | 1,230 | 8.0% | 14,781 | 96.1% |

| 2012 | 16,050 | 1,278 | 8.0% | 16,059 | 100.2% |

| 2013 | 16,500 | 673 | 4.1% | 16,732 | 101.3% |

| 2014 | 17,200 | 1,078 | 6.3% | 17,810 | 103.4% |

| 2015 | 17,900 | 328 | 1.8% | 18,138 | 101.3% |

| 2016 (Oct. '15 – Jul. '16 only) |

~1,290 | ~7.0% | ~19,428 | ~106.1% |

On July 30, 2015, the BEA released a revision to 2012–2015 GDP figures. The figures for this table were corrected on that day with changes to FY 2013 and 2014, but not 2015 as FY 2015 is updated within a week with the release of debt totals for July 31, 2015.

On June 25, 2014, the BEA announced a 15-year revision of GDP figures would take place on July 31, 2014. The figures for this table were corrected after that date with changes to FY 2000, 2003, 2008, 2012, 2013 and 2014. The more precise FY 1999–2014 debt figures are derived from Treasury audit results. The variations in the 1990s and FY 2015 figures are due to double-sourced or relatively preliminary GDP figures respectively. A comprehensive revision GDP revision dated July 31, 2013, was described on the Bureau of Economic Analysis website. In November 2013 the total debt and yearly debt as a percentage of GDP columns of this table were changed to reflect those revised GDP figures.Historical debt ceiling levels

Note that this table does not go back to 1917 when the debt ceiling started.

| Table of historical debt ceiling levels[168] | |||

|---|---|---|---|

| Date | Debt Ceiling (billions of dollars) |

Change in Debt Ceiling (billions of dollars) |

Statute |

| June 25, 1940 | 49[169] | ||

| February 19, 1941 | 65 | +16 | |

| March 28, 1942 | 125 | +60 | |

| April 11, 1943 | 210 | +85 | |

| June 9, 1944 | 260 | +50 | |

| April 3, 1945 | 300 | +40 | |

| June 26, 1946 | 275 | −25 | |

| August 28, 1954 | 281 | +6 | |

| July 9, 1956 | 275 | −6 | |

| February 26, 1958 | 280 | +5 | |

| September 2, 1958 | 288 | +8 | |

| June 30, 1959 | 295 | +7 | |

| June 30, 1960 | 293 | −2 | |

| June 30, 1961 | 298[170] | +5 | |

| July 1, 1962 | 308 | +10 | |

| March 31, 1963 | 305 | −3 | |

| June 25, 1963 | 300 | −5 | |

| June 30, 1963 | 307 | +7 | |

| August 31, 1963 | 309 | +2 | |

| November 26, 1963 | 315 | +6 | |

| June 29, 1964 | 324 | +9 | |

| June 24, 1965 | 328 | +4 | |

| June 24, 1966 | 330 | +2 | |

| March 2, 1967 | 336 | +6 | |

| June 30, 1967 | 358 | +22 | |

| June 1, 1968 | 365 | +7 | |

| April 7, 1969 | 377 | +12 | |

| June 30, 1970 | 395 | +18 | |

| March 17, 1971 | 430 | +35 | |

| March 15, 1972 | 450[171] | +20 | |

| October 27, 1972 | 465 | +15 | |

| June 30, 1974 | 495 | +30 | |

| February 19, 1975 | 577 | +82 | |

| November 14, 1975 | 595 | +18 | |

| March 15, 1976 | 627 | +32 | |

| June 30, 1976 | 636 | +9 | |

| September 30, 1976 | 682 | +46 | |

| April 1, 1977 | 700 | +18 | |

| October 4, 1977 | 752 | +52 | |

| August 3, 1978 | 798 | +46 | |

| April 2, 1979 | 830 | +32 | |

| September 29, 1979 | 879[172] | +49 | |

| June 28, 1980 | 925 | +46 | |

| December 19, 1980 | 935 | +10 | |

| February 7, 1981 | 985 | +50 | |

| September 30, 1981 | 1,079 | +94 | |

| June 28, 1982 | 1,143 | +64 | |

| September 30, 1982 | 1,290 | +147 | |

| May 26, 1983 | 1,389 | +99 | Pub. L. 98–34 |

| November 21, 1983 | 1,490 | +101 | Pub. L. 98–161 |

| May 25, 1984 | 1,520 | +30 | |

| June 6, 1984 | 1,573 | +53 | Pub. L. 98–342 |

| October 13, 1984 | 1,823 | +250 | Pub. L. 98–475 |

| November 14, 1985 | 1,904 | +81 | |

| December 12, 1985 | 2,079 | +175 | Pub. L. 99–177 |

| August 21, 1986 | 2,111 | +32 | Pub. L. 99–384 |

| October 21, 1986 | 2,300 | +189 | |

| May 15, 1987 | 2,320[173] | +20 | |

| August 10, 1987 | 2,352 | +32 | |

| September 29, 1987 | 2,800 | +448 | Pub. L. 100–119 |

| August 7, 1989 | 2,870 | +70 | |

| November 8, 1989 | 3,123 | +253 | Pub. L. 101–140 |

| August 9, 1990 | 3,195 | +72 | |

| October 28, 1990 | 3,230 | +35 | |

| November 5, 1990 | 4,145 | +915 | Pub. L. 101–508 |

| April 6, 1993 | 4,370 | +225 | |

| August 10, 1993 | 4,900 | +530 | Pub. L. 103–66 |

| March 29, 1996 | 5,500 | +600 | Pub. L. 104–121 (text) (PDF) |

| August 5, 1997 | 5,950 | +450 | Pub. L. 105–33 (text) (PDF) |

| June 11, 2002 | 6,400[174] | +450 | Pub. L. 107–199 (text) (PDF) |

| May 27, 2003 | 7,384 | +984 | Pub. L. 108–24 (text) (PDF) |

| November 16, 2004 | 8,184[174] | +800 | Pub. L. 108–415 (text) (PDF) |

| March 20, 2006 | 8,965[175] | +781 | Pub. L. 109–182 (text) (PDF) |

| September 29, 2007 | 9,815 | +850 | Pub. L. 110–91 (text) (PDF) |

| June 5, 2008 | 10,615 | +800 | Pub. L. 110–289 (text) (PDF) |

| October 3, 2008 | 11,315[176] | +700 | Pub. L. 110–343 (text) (PDF) |

| February 17, 2009 | 12,104[177] | +789 | Pub. L. 111–5 (text) (PDF) |

| December 24, 2009 | 12,394 | +290 | Pub. L. 111–123 (text) (PDF) |

| February 12, 2010 | 14,294 | +1,900 | Pub. L. 111–139 (text) (PDF) |

| January 30, 2012 | 16,394 | +2,100 | Pub. L. 112–25 (text) (PDF) |

| February 4, 2013 | Suspended | ||

| May 19, 2013 | 16,699 | +305 | Pub. L. 113–3 (text) (PDF) |

| October 17, 2013 | Suspended | ||

| February 7, 2014 | 17,212 and auto-adjust |

+213 | Pub. L. 113–83 (text) (PDF) |

| March 15, 2015 | 18,113 End of auto adjust |

+901 | Pub. L. 113–83 (text) (PDF) |

| October 30, 2015 | Suspended[178] | Pub. L. 114–74 (text) (PDF) | |

| March 15, 2017 | 19,847 (de facto) | +1,734 | [n 1] |

| September 8, 2017 | Suspended | [n 2] | Pub. L. 115–56 (text) (PDF) |

| March 1, 2019 | 22,030 (de facto) | +2,183 | [179] |

| August 2, 2019 | Suspended | [n 3] | Pub. L. 116–37 (text) (PDF)[180] |

| July 31, 2021 | 28,500 (de facto) | +6,470 | [181] |

| October 14, 2021 | 28,900 | +480 | Pub. L. 117–50 (text) (PDF)[182] |

| December 16, 2021 | 31,400 | +2,500 | Pub. L. 117–73 (text) (PDF)[183] |

| June 3, 2023 | Suspended[n 4] | [184][185] | |

Reference for values between 1993 and 2015:[186]

Note that:

- The figures are unadjusted for the time value of money, such as interest and inflation and the size of the economy that generated a debt.

- The debt ceiling is an aggregate of gross debt, which includes debt in hands of public and in intragovernment accounts.

- The debt ceiling does not necessarily reflect the level of actual debt.

- From March 15 to October 30, 2015 there was a de facto debt limit of $18.153 trillion,[187] due to use of extraordinary measures.

State and local government debt

U.S. states have a combined state and local government debt of about $3 trillion[188] and another $5 trillion in unfunded liabilities.[189][190][191]

See also

- Criticism of the Federal Reserve

- Financial position of the United States

- List of countries by public debt

- Sovereign default

- Troubled Asset Relief Program

- United States federal government credit-rating downgrades

- World debt

Notes

- ^ No official ceiling published. The debt on March 15, 2017 was $19.846 trillion after reaching an all time high of $19.977 trillion on December 30, 2016. See the US government database on the debt.

- ^ The debt rose to over $20.1 trillion on September 8, 2017, when the bill to continue the debt limit suspension for fiscal 2018 was passed. The fiscal year started at over $20.3 trillion of debt. US government database on the debt.

- ^ The debt rose to over $22.31 trillion on August 2, 2019. US government database on the debt; Archived 2020-08-01 at the Wayback Machine.

- ^ Until January 1, 2025.

References

- ^ "Historical Tables – Table 1.2 – Summary of Receipts, Outlays, and Surpluses or Deficits (-) as Percentages of GDP: 1930–2017" (PDF). Office of Management and Budget. Retrieved April 16, 2012.

- ^ "Federal debt basics – How large is the federal debt?". Government Accountability Office. Archived from the original on July 6, 2011. Retrieved April 28, 2012.

- ^ "The Budget and Economic Outlook: 2024 to 2034". CBO. February 7, 2024. Retrieved February 7, 2024.

- ^ "The 2022 Long-Term Budget Outlook". Congressional Budget Office. July 27, 2022. Retrieved September 30, 2022.

- ^ About 0.8% of debt ($1009 billion) is not covered by the ceiling, per The Debt Limit: History and Recent Increases, p. 4. (Note: This includes pre-1917 debt), fpc.state.gov; accessed August 22, 2016.

- ^ a b "An update to the budget outlook 2020 to 2030". September 2, 2020. Retrieved September 6, 2020.

- ^ "Foreign Holdings of Federal Debt" (PDF). Congressional Research Service. Retrieved August 29, 2022 – via Federation of American Scientists.

- ^ "Foreign Holdings of Federal Debt" (PDF). Congressional Budget Office. May 25, 2022. Retrieved September 29, 2022.

- ^ Rappeport, Alan (February 1, 2022). "U.S. National Debt Tops $30 Trillion as Borrowing Surged Amid Pandemic". The New York Times. ISSN 0362-4331. Retrieved February 2, 2022.

- ^ "Debt to the Penny". fiscaldata.treasury.gov. United States Department of the Treasury. Retrieved December 4, 2023.

- ^ a b "What is the national debt?". fiscaldata.treasury.gov. United States Department of the Treasury. Retrieved August 18, 2023.

- ^ Fox, Michelle (March 1, 2024). "The U.S. national debt is rising by $1 trillion about every 100 days". CNBC. Retrieved March 1, 2024.

- ^ "Gross National Debt Reaches $36 Trillion | Committee for a Responsible Federal Budget". www.crfb.org. November 22, 2024. Retrieved November 23, 2024.

- ^ "Congressional Budget Office – Historical Data on the Federal Debt". cbo.gov. 2010. Retrieved January 3, 2012.

- ^ a b Monthly Budget Review for September 2018 (PDF) (Report). Congressional Budget Office. October 5, 2018. p. 5. Retrieved October 30, 2018.

- ^ a b c d e f Davidson, Kate (October 29, 2018). "Treasury Expects to Issue Over $1 Trillion in Debt in 2018". Washington, DC: Wall Street Journal. Retrieved October 30, 2018.

Debt issuance this year could be highest since 2010, the Treasury said, as higher government spending and stagnant tax revenues have pushed the deficit higher.

- ^ a b c d e Bryan, Bob (October 30, 2018). "The US will issue over $1.3 trillion in new debt in 2018, the highest amount since the depths of the recession". Business Insider. Retrieved October 30, 2018.

- ^ Long, Heather (February 3, 2018), "The U.S. Government Is Set To Borrow Nearly $1 Trillion This Year, an 84 Percent Jump from Last Year", The Washington Post

- ^ Daily Treasury Statement (DTS) (PDF) (Report). Treasury Department. October 29, 2018. Retrieved October 30, 2018.

- ^ The Bureau of the Fiscal Service (July 20, 2020). "Debt to the Penny". www.treasurydirect.gov. Treasury Department. Retrieved July 22, 2020.

- ^ "The World Factbook — Central Intelligence Agency". www.cia.gov. Archived from the original on June 13, 2007.

- ^ a b c "The Budget and Economic Outlook: 2018 to 2028 – Congressional Budget Office". www.cbo.gov. April 9, 2018.

- ^ "The 2012 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds" (PDF). Ssa.gov. Retrieved August 27, 2016.

- ^ "Social Security Trust Fund 2010 Report Summary". Ssa.gov. Retrieved May 18, 2011.

- ^ "Federal debt basics – What is the difference between the two types of federal debt?". Government Accountability Office. Archived from the original on July 6, 2011. Retrieved April 28, 2012.

- ^ "Measuring the Deficit: Cash vs. Accrual". Government Accountability Office. Retrieved January 19, 2011.

- ^ Fannie Mae, Freddie Mac to Be Kept Off Budget, White House Says (September 12, 2008), Bloomberg.com.

- ^ The case for keeping Fannie Mae and Freddie Mac off the government's books has gotten even weaker, professional.wsj.com (subscription required)

- ^ Barr, Colin (September 7, 2008). "Paulson readies the 'bazooka'", CNN.com; retrieved January 17, 2011.

- ^ Timiraos, Nick (March 3, 2014). "Investor Fires Salvo Against Fannie, Freddie-Viewed March 2014". The Wall Street Journal. Retrieved August 24, 2016.

- ^ a b Congress of the United States, Government Accountability Office (February 13, 2009). "The federal government's financial health: a citizen's guide to the 2008 financial report of the United States government", pp. 7–8 Archived August 5, 2011, at the Wayback Machine, gao.gov; retrieved February 1, 2011.

- ^ Peter G. Peterson Foundation (April 2010). "Citizen's guide 2010: Figure 10 p. 16" Archived February 10, 2011, at the Wayback Machine. Peter G. Peterson Foundation website; retrieved February 5, 2011.

- ^ "Government – Debt Position and Activity Report". TreasuryDirect. Archived from the original on March 7, 2016. Retrieved June 27, 2017.

- ^ CBO – The Budget and Economic Outlook: Fiscal Years 2012 to 2022 – See Historical Budget Data Supplement, Cbo.gov, January 2012.

- ^ "The World Factbook". Central Intelligence Agency. April 6, 2022.

- ^ OECD. "OECD Statistics". Stats.oecd.org. Retrieved August 27, 2016.

- ^ Multiple references:

- Debt to the Penny (Daily History Search Application) Archived April 18, 2011, at the Wayback Machine

- US national debt surpasses $16 trillion – Boston Business Journal

- United States Department of the Treasury, Bureau of the Public Debt (December 2010). "The debt to the penny and who holds it". TreasuryDirect. Retrieved August 26, 2012.

- ^ a b "CBO Budget and Economic Outlook 2009–2019". CBO. January 7, 2009. Retrieved November 21, 2016.

- ^ Table 1.1 – Summary of Receipts, Outlays, and Surpluses or Deficits (-): 1789–2017 Archived July 6, 2012, at the Wayback Machine, Whitehouse.gov; accessed August 24, 2016.

- ^ "TreasuryDirect Historical Debt Outstanding". Treasury Direct. Archived from the original on May 8, 2019. Retrieved November 26, 2016.

- ^ a b "Money in budgets, but supplementals aren't going away". PolitiFact. Retrieved November 26, 2016.

- ^ "Debt to the Penny". U.S. Treasury Fiscal Data. Retrieved August 23, 2022.

- ^ "Treasury Direct-Monthly Statement of the Public Debt Held by the U.S." (PDF). September 2014. Archived from the original (PDF) on October 26, 2014. Retrieved November 30, 2014.

- ^ Marc Labonte; Jared C. Nagel (July 9, 2021). Foreign Holdings of Federal Debt (PDF) (Report). Congressional Research Service. p. ii. Retrieved July 21, 2021.

- ^ Amadeo, Kimberly (January 10, 2011). "The U.S. debt and how it got so big". About.com. Archived from the original on March 16, 2007. Retrieved July 7, 2007.

- ^ Schoen, John W. (March 4, 2007) "Just who owns the U.S. national debt?" NBC News; retrieved January 17, 2011.

- ^ "Is it a Risk for America that China Holds over $1 Trillion in U.S. Debt?". February 2, 2016.

- ^ Krugman, Paul (January 1, 2012). "Nobody Understands Debt". The New York Times. Retrieved February 4, 2012.

- ^ "US Net International Investment Position from BEA". February 1, 2019. Retrieved April 1, 2019.

- ^ a b CBO The 2019 Long-Term Budget Outlook, cbo.gov; accessed June 25, 2019.

- ^ Saint Louis Federal Reserve (2012) "5-Year Treasury Inflation-Indexed Security, Constant Maturity" FRED Economic Data chart from government debt auctions (the x-axis at y=0 represents the inflation rate over the life of the security)

- ^ a b Carmen M. Reinhart and M. Belen Sbrancia (March 2011) "The Liquidation of Government Debt" National Bureau of Economic Research working paper No. 16893

- ^ David Wessel (August 8, 2012) "When Interest Rates Turn Upside Down" The Wall Street Journal (full text Archived January 20, 2013, at the Wayback Machine)

- ^ Lawrence Summers (June 3, 2012) "Breaking the negative feedback loop" Reuters

- ^ William H. Gross (May 2, 2011) "The Caine Mutiny (Part 2)" Archived October 13, 2012, at the Wayback Machine PIMCO Investment Outlook

- ^ "Why the U.S. Government Never, Ever Has to Pay Back All Its Debt", The Atlantic, February 1, 2013.

- ^ Ambrose Evans-Pritchard (October 21, 2012) "IMF's epic plan to conjure away debt and dethrone bankers" The Telegraph

- ^ Jaromir Benes and Michael Kumhof (August 2012) "The Chicago Plan Revisited", International Monetary Fund working paper WP/12/202; accessed November 6, 2016.

- ^ "Debt-Deflation versus the Liquidity Trap: the Dilemma of Nonconventional Monetary Policy" CNRS, CES, Paris School of Economics, ESCP-Europe, October 23, 2012

- ^ ""Credit and debt in Economic Theory: Which Way forward?" Economics of Credit and Debt workshop, November 2012". Archived from the original on May 14, 2013. Retrieved February 13, 2013.

- ^ "The economic crisis: How to stimulate economies without increasing public debt" Archived September 16, 2012, at the Wayback Machine, Centre for Economic Policy Research, August 2012.

- ^ a b Huntley, Jonathan (July 27, 2010). "Federal debt and the risk of a fiscal crisis". Congressional Budget Office: Macroeconomic Analysis Division; retrieved February 2, 2011.

- ^ Carney, John. "Has the United States Ever Defaulted on Its Debt?". CNBC. Retrieved January 18, 2013.

- ^ Comstock, Courtney. "10 Things You Need To Know About The Debt Ceiling". The Fiscal Times. Retrieved January 18, 2013.

- ^ Zweig, Jason. "Own Government Bonds? Here's Why You Should Be Worried". The Wall Street Journal. Retrieved January 18, 2013.

- ^ Marron, Donald. "The Day the United States Defaulted on Treasury Bills". Retrieved January 18, 2013.

- ^ O'brien, Matthew. "Here's What Happened the Last Time the U.S. Defaulted on Its Debt". The Atlantic. Retrieved January 18, 2013.

- ^ Siegel, Robert. "When Did The U.S. Last Default On Treasury Bonds?". NPR. Retrieved January 18, 2013.

- ^ The Debt Limit: History and Recent Increases, October 2013, p 4.

- ^ "Q&A: Everything You Should Know About the Debt Ceiling | Committee for a Responsible Federal Budget". www.crfb.org. May 5, 2023. Retrieved June 1, 2023.

- ^ Pullen, John Patrick (December 20, 2017). "Here's When the GOP Tax Reform Bill Will Take Effect". Fortune. Retrieved December 23, 2017.

- ^ Werner, Erica; DeBonis, Mike (March 22, 2018). "House approves jam-packed $1.3 trillion spending bill". The Washington Post. ISSN 0190-8286. Retrieved October 30, 2018.

- ^ Bryan, Bob (October 15, 2018). "The US budget deficit ballooned to $779 billion this year, the highest since 2012, driven by Trump's tax law and the massive budget deal". Business Insider. Retrieved October 30, 2018.

- ^ U.S. House of Representatives Republican Caucus (May 27, 2010). "The perils of rising government debt", budget.house.gov; retrieved February 2, 2011.

- ^ Herndon, Thomas. "Herndon Responds To Reinhart Rogoff". Business Insider. Retrieved April 22, 2013.

- ^ Weisenthal, Joe. "Reinhart And Rogoff Admit Excel Blunder". Business Insider. Retrieved April 22, 2013.

- ^ Herndon, Thomas, Michael Ash, and Robert Pollin, "Does High Public Debt Consistently Stifle Economic Growth? A Critique of Reinhart and Rogoff" Archived April 18, 2013, at the Wayback Machine, University of Massachusetts Amherst Department of Economics, April 15, 2013.

- ^ "Reinhart-Rogoff recrunch the numbers". Financial Times.

- ^ a b Krugman, Paul (May 27, 2010). "Bad analysis at the deficit commission". The New York Times: The Opinion Pages: Conscience of a Liberal Blog. Retrieved February 9, 2011.

- ^ Vikas Bajaj (April 17, 2013) "Does High Debt Cause Slow Growth?", The New York Times; retrieved May 7, 2013.

- ^ Matthew O'Brien, "Forget Excel: This Was Reinhart and Rogoff's Biggest Mistake", The Atlantic; accessed November 6, 2016.

- ^ Bernanke, Ben S. (April 27, 2010). "Speech before the National Commission on Fiscal Responsibility and Reform: Achieving fiscal sustainability", Federalreserve.gov; retrieved February 2, 2011.