Fuel taxes in the United States

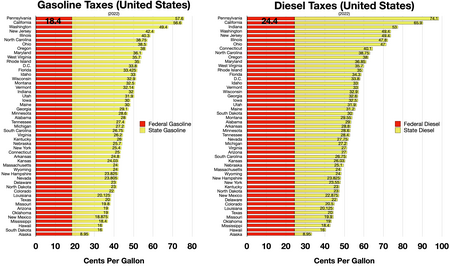

The United States federal excise tax on gasoline is 18.4 cents per gallon and 24.4 cents per gallon for diesel fuel.[1][2] Proceeds from the tax partly support the Highway Trust Fund. The federal tax was last raised on October 1, 1993, and is not indexed to inflation, which increased 111% from Oct. 1993 until Dec. 2023. On average, as of April 2019, state and local taxes and fees add 34.24 cents to gasoline and 35.89 cents to diesel, for a total US volume-weighted average fuel tax of 52.64 cents per gallon for gas and 60.29 cents per gallon for diesel.[3]

State taxes

The first US state to tax fuel was Oregon, introduced on February 25, 1919.[4] It was a 1¢/gal tax.[5] In the following decade, all of the US states (48 at the time), along with the District of Columbia, introduced a gasoline tax. By 1939, many states levied an average fuel tax of 3.8¢/gal (1¢/L).

In the years since being created, state fuel taxes have undergone many revisions.[6] While most fuel taxes were initially levied as a fixed number of cents per gallon, as of 2016, nineteen states and District of Columbia have fuel taxes with rates that vary alongside changes in the price of fuel, the inflation rate, vehicle fuel-economy, or other factors.[7]

The table below includes state and local taxes and fees. The American Petroleum Institute uses a weighted average of local taxes by municipality population to create an average tax for the entire state. Similarly, the national average is weighted by the fuel volume sold in each state. Because many states with the highest taxes also have higher populations, more states (i.e., the less populated ones) have below-average taxes than above-average taxes.

Most states exempt gasoline from general sales taxes. However, several states collect full or partial sales tax in addition to the excise tax. Sales tax is not reflected in the rates below.

| State | Gasoline tax (¢/gal) (excludes federal tax of 18.4¢/gal) |

Diesel tax (¢/gal) (excludes federal tax of 24.4¢/gal) |

Notes |

|---|---|---|---|

| Alabama | 29.21 | 30.15 | |

| Alaska | 14.66 | 14.40 | |

| Arizona | 19.00 | 27.00 | |

| Arkansas | 24.80 | 28.80 | |

| California | 66.98 | 93.08 | Gasoline subject to 2.25% sales tax. Diesel subject to 9.25% sales tax. |

| Colorado | 22.00 | 20.50 | In Colorado Springs, Off-road Dyed Diesel and Gasoline are subject to a local city sales tax. |

| Connecticut | 35.75 | 44.10 | Subject to additional 8.1% sales tax |

| Delaware | 23.00 | 22.00 | |

| District of Columbia | 28.80 | 28.80 | |

| Florida | 42.26 | 35.57 | may also be subject to local option taxes of up to an additional 12 cents |

| Georgia | 29.10 | 32.60 | subject to local sales tax |

| Hawaii | 50.17 | 50.81 | also subject to county tax of 8.8-18.0 cents and additional sales tax |

| Idaho | 33.00 | 33.00 | |

| Illinois | 39.2[9] | 46.7 | Also subject to 6.25% state sales tax and varying local and municipal sales taxes.[10] Interstate carriers are subject to interstate motor fuel use higher taxes.[11] |

| Indiana | 51.1 | 54.00 | Indiana has two taxes on gasoline — a 7% sales tax (that is calculated monthly) and a tax directed to infrastructure projects.[12] |

| Iowa | 30.00 | 32.50 | |

| Kansas | 24.03 | 26.03 | |

| Kentucky | 26.00 | 23.00 | |

| Louisiana | 20.01 | 20.01 | |

| Maine | 30.01 | 31.21 | |

| Maryland | 36.10 | 36.85 | |

| Massachusetts | 26.54 | 26.54 | |

| Michigan | 45.12 | 44.46 | subject to additional 6% sales tax |

| Minnesota | 30.60 | 30.60 | |

| Mississippi | 18.79 | 18.40 | |

| Missouri | 22.00 | 22.00 | |

| Montana | 32.75 | 30.20 | |

| Nebraska | 28.60 | 28.00 | |

| Nevada | 50.48 | 28.56 | also subject to additional local taxes |

| New Hampshire | 23.83 | 23.83 | |

| New Jersey | 42.4 | 49.4 | |

| New Mexico | 18.88 | 22.88 | |

| New York | 46.19 | 44.64 | subject to additional state sales tax of 4% (capped at $2.00/gal) and local sales tax (not capped), average combined sales taxes add roughly 20 cents |

| North Carolina | 40.5 | 40.5 | |

| North Dakota | 23.00 | 23.00 | |

| Ohio | 38.51 | 47.01 | |

| Oklahoma | 20.00 | 20.00 | |

| Oregon | 38.83 | 38.06 | additional local option of 1 to 5 cents |

| Pennsylvania | 58.70 | 75.20 | |

| Rhode Island | 35.00 | 35.00 | |

| South Carolina | 26.75 | 26.75 | |

| South Dakota | 30.00 | 30.00 | |

| Tennessee | 27.40 | 28.40 | |

| Texas | 20.00 | 20.00 | |

| Utah | 31.41 | 31.41 | |

| Vermont | 31.28 | 32.00 | |

| Virginia | 26.20 | 27.00 | |

| Washington | 49.40 | 49.40 | |

| West Virginia | 35.70 | 35.70 | |

| Wisconsin | 32.90 | 32.90 | |

| Wyoming | 24.00 | 24.00 |

Federal taxes

The first federal gasoline tax in the United States was created on June 6, 1932, with the enactment of the Revenue Act of 1932, which taxed 1¢/gal (0.3¢/L). Since 1993, the US federal gasoline tax has been unchanged (and not adjusted for inflation of nearly 113 percent through 2023) at 18.4¢/gal (4.86¢/L). Unlike most other goods in the US, the price advertised (e.g., on pumps and stations' signs) includes all taxes, as opposed to inclusion at the point of purchase (i.e., as opposed to prices of goods in, e.g., many stores advertised on shelves without tax which is instead calculated at checkout by many vendors).

Then-Secretary of Transportation Mary Peters stated on August 15, 2007, that about 60% of federal gas taxes are used for highway and bridge construction. The remaining 40% goes to earmarked programs, including a minority for mass transit projects.[15] However, revenues from other taxes are also used in federal transportation programs.

Federal tax revenues

Federal fuel taxes raised $36.4 billion in Fiscal Year 2016, with $26.1 billion raised from gasoline taxes and $10.3 billion raised from diesel and special motor fuel taxes.[16] The tax was last raised in 1993 and is not indexed to inflation. Total inflation from 1993 until 2017 was 68 percent or up to 77 percent, depending on the source.[17][18]

Public policy

Some policy advisors believe an increased tax is needed to fund and sustain the country's transportation infrastructure, including mass transit. As infrastructure construction costs have grown and vehicles have become more fuel efficient, the purchasing power of fixed-rate gas taxes has declined (i.e., the unchanged tax rate from 1993 provides less real money than it originally did, when adjusted for inflation).[19] To offset this loss of purchasing power, The National Surface Transportation Infrastructure Financing Commission issued a detailed report in February 2009 recommending a 10 cent increase in the gasoline tax, a 15 cent increase in the diesel tax, and a reform tying both of these tax rates to inflation.[20]

Critics of gas tax increases argue that much of the revenue is diverted to other government programs and debt servicing unrelated to transportation infrastructure.[21] However, other researchers have noted that these diversions can occur in both directions and that gas taxes and "user fees" paid by drivers are not high enough to cover the full cost of road-related spending.[22]

Some believe an increased fuel cost would encourage less consumption and reduce America's dependence on foreign oil.[citation needed] Americans sent nearly $430 billion to other countries in 2008 for the cost of imported oil.[citation needed] However, significantly since 2008, increased domestic output (e.g., fracking of shale and other energy resource discoveries) and rapidly growing production efficiencies have reduced considerably such spending, and this falling trend is expected to continue.[23]

Aviation fuel taxes

Aviation gasoline (Avgas): The tax on aviation gasoline is $0.194 per gallon. [citation needed] When used in a fractional ownership program aircraft, gasoline also is subject to a surtax of $0.141 per gallon.[citation needed]

Kerosene for use in aviation (Jet fuel): Generally, kerosene is taxed at $0.244 per gallon unless a reduced rate applies.[citation needed] For kerosene removed directly from an on-airport terminal (ramp) directly into the fuel tank of an aircraft for use in non-commercial aviation, the tax rate is $0.219.[citation needed] The rate of $0.219 also applies if kerosene is transported directly into any aircraft from a qualified refueler truck, tanker, or tank wagon that is loaded with the kerosene (again, when done directly on-airport, e.g., on the ramp). Notably, the airport terminal doesn't need to be a passenger-carrying, secured airport terminal for this rate to apply. However, the refueling truck, tanker, or tank wagon must meet the requirements discussed later under particular refueler trucks, tankers, and tank wagons treated as terminals.

These taxes mainly fund airport and Air Traffic Control operations by the Federal Aviation Administration (FAA), of which commercial aviation is the biggest user.[citation needed]

| State | Aviation Fuel Tax (excludes federal tax of 19.4¢/gal) |

Jet Fuel Tax (excludes federal tax of 24.4¢/gal) |

Notes |

|---|---|---|---|

| Alabama | 9.5 | 3.5 | |

| Alaska | 4.7 | 3.2 | |

| Arizona | 5.0 | 0 | Jet Fuel is not subject to Motor Fuel Taxes |

| Arkansas | 21.8 | 22.8 | Aviation Fuel and Jet Fuel are subject to 6.5% State Sales and Use Tax plus local sales and use tax based on the point of delivery |

| California | 18.0 | 2.0 | |

| Colorado | 6.0 | 4.0 | |

| Connecticut | exempt | exempt | Subject to additional 8.1% sales tax |

| Delaware | 23.00 | exempt | |

| District of Columbia | 23.50 | 23.50 | |

| Florida | 6.95[26] | 6.9 | may also be subject to local option taxes of up to an additional 12 cents |

| Georgia | 7.5 | 7.5 | subject to local sales tax |

| Hawaii | 1.0 | 1.0 | also subject to county tax of 8.8-18.0 cents and additional sales tax |

| Idaho | 7.0 | 6.0 | |

| Illinois | 1.1 | 1.1 | |

| Indiana | 49.0 | 21.0 | |

| Iowa | 8.0 | 5.0 | |

| Kansas | 24.0 | 26.0 | |

| Kentucky | 26.00 | exempt | Jet Fuel is subject to 6% Sales Tax |

| Louisiana | exempt | exempt | Exempt if used for aviation use; otherwise 20.0 cents per gallon |

| Maine | 30.0 | 3.4 | |

| Maryland | 7.0 | 7.0 | |

| Massachusetts | 27.3 | 10.9 | [27] |

| Michigan | 3.0 | 3.0 | |

| Minnesota | 5.0 | 15.0 | |

| Mississippi | 6.4 | 5.25 | |

| Missouri | 9.0 | exempt | Additional charges apply for agriculture inspection fee and underground storage fee |

| Montana | 4.0 | 4.0 | |

| Nebraska | 5.0 | 3.0 | |

| Nevada | 2.0 | 1.0 | also subject to additional county taxes, up to 8 cents per gallon on Aviation Fuel, 4 cents per gallon for Jet Fuel |

| New Hampshire | 4.0 | 2.0 | The rate for Jet Fuel for aircraft operating under FAR Part 121 is 0.5 cents per gallon |

| New Jersey | 10.56 | 13.56 | |

| New Mexico | 17.0 | See notes | Jet Fuel is subject to gross receipts tax |

| New York | 6.5 | 6.5 | |

| North Carolina | 0.0025 | 0.0025 | tax is an inspection fee |

| North Dakota | 8.0 | 8.0 | |

| Ohio | exempt | exempt | |

| Oklahoma | 0.08 | 0.08 | Also, there is a $.01 per gallon Underground Storage Fee is due on all motor fuels |

| Oregon | 11.0 | 3.0 | |

| Pennsylvania | 5.5 | 1.6 | |

| Rhode Island | exempt | exempt | |

| South Carolina | 0.25 | 0.25 | Taxes are for inspection fee and environmental impact fee |

| South Dakota | 6.0 | 4.0 | |

| Tennessee | 1.4 | 1.4 | |

| Texas | 20.0 | 20.0 | |

| Utah | 9.0 | 6.5 | 2.5 cents for federally certificated air carriers (@ international airport) 6.5 cents for federally certificated air carriers (airports other than international) 9 cents/gallon all other operations |

| Vermont | 31.22 | See Notes | Jet Fuel is subject to 6% Sales Tax |

| Virginia | 5.0 | 5.0 | |

| Washington | 11.0 | 11.0 | |

| West Virginia | 11.7 | 11.7 | |

| Wisconsin | 6.0 | 6.0 | |

| Wyoming | 5.0 | 5.0 |

See also

- Carbon taxes in the United States

- Federal Highway Trust Fund (United States)

- Gas tax holiday

- National Association of Convenience Stores

- RBOB - (Reformulated Blendstock for Oxygenate Blending)

US tax system:

References

- ^ "Petroleum Marketing Explanatory Notes: The EIA-782 survey" (PDF). US Energy Information Administration/Petroleum Marketing Monthly.

- ^ Federal Highway Administration US Department of Transportation, Federal Highway Administration: When did the Federal Government begin collecting the gas tax?

- ^ "State Motor Fuel Taxes: Notes Summary" (PDF). American Petroleum Institute. April 1, 2019.

- ^ Corning, Howard M. Dictionary of Oregon History. Binfords & Mort Publishing, 1956.

- ^ "A brief history of Oregon vehicle fees and fuel taxes". The Oregonian/Oregon Live. December 12, 2010.

- ^ Ang-Olson, Jeffrey; et al. (July 1999). "Variable-Rate State Gasoline Taxes" (PDF). Institute of Transportation Studies, University of California Berkeley.

- ^ "Most Americans Live in States with Variable-Rate Gas Taxes". Institute on Taxation Economic Policy. February 5, 2016.

- ^ "Motor Fuel Taxes".

- ^ "Motor Fuel Tax Rates and Fees".

- ^ "Illinois fuel tax burden among highest".

- ^ "Motor Fuel Use Tax General Overview".

- ^ "Indiana gas tax increases while state eyes inflation relief". June 21, 2022.

- ^ "Motor Fuels Tax Rate Will Increase to 40.5 Cents per Gallon in 2023 | NCDOR".

- ^ McCormally, Kevin (July 2, 2014). "A Brief History of the Federal Gasoline Tax". Kiplinger. Retrieved October 7, 2021.

- ^ Online NewsHour: Conversation | Peters Discusses Infrastructure | August 15, 2007 | PBS

- ^ "Status of The Federal Highway Trust Fund". US Department of Transportation, Federal Highway Administration.

- ^ CPI Inflation Calculator

- ^ "What are the major federal excise taxes, and how much money do they raise?".

- ^ "A Federal Gas Tax for the Future". Institute on Taxation Economic Policy. September 23, 2013.

- ^ "Paying Our Way" (PDF). Archived from the original (PDF) on April 2, 2009.

- ^ Paletta, Damian (July 17, 2014). "States Siphon Gas Tax for Other Uses - WSJ". Wall Street Journal.

- ^ Bishop-Henchman, Joseph (January 3, 2014). "Gasoline Taxes and User Fees Pay for Only Half of State & Local Road Spending". Tax Foundation. Archived from the original on May 29, 2024. Retrieved August 29, 2024.

- ^ "China is now the world's largest net importer of petroleum and other liquid fuels - Today in Energy - U.S. Energy Information Administration (EIA)".

- ^ " "Motor Fuel Tax Information by State, September 2017". Federation of Tax Administrators. Retrieved April 29, 2019.

- ^ U.S. Energy Information Administration. "State Aviation Fuel Rates - February 2021". Retrieved March 18, 2021.

- ^ "Florida Announces 2019 Motor Fuel Tax Rates". November 30, 2018.

- ^ "Massachusetts Fuel Excise Rates" (PDF). Retrieved April 29, 2019.