Plug-in electric vehicles in the United States

(sales as of December 2020)

The adoption of plug-in electric vehicles in the United States is supported by the American federal government, and several states and local governments.

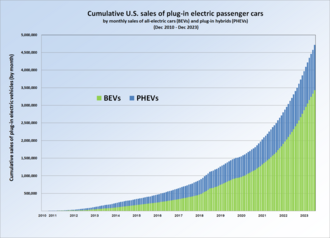

As of December 2023, cumulative sales in the U.S. totaled 4,7 million plug-in electric cars since 2010, led by all-electric cars.[4] Sales totaled 1,402,371 units in 2023, with a market share of 9.1%. This was the first time the American market surpassed the 1 million sales mark.[4] The American stock represented 20% of the global plug-in car fleet in use by the end of 2019 and the U.S. had the world's third largest stock of plug-in passenger cars after China (47%) and Europe (25%).[5]

The U.S. market share of plug-in electric passenger cars increased from 0.14% in 2011, to 0.66% in 2015,[6][7] to 1.13% in 2017, 2.1% in 2018, slightly declined to 1.9% in 2019,[8][9][10] rose to 2.2% in 2020, 4.0% in 2021, 6.8% in 2022, and achieved a record 9.1% in 2023.[4][11] California is the largest regional market in the country, with 1 million plug-in cars registered by November 2021, 46% of the national stock.[12]

As of December 2020, the Tesla Model 3 all-electric car is the all-time best selling plug-in electric car with an estimated 395,600 units delivered, followed by the Tesla Model S electric car with about 172,400, and the Chevrolet Volt plug-in hybrid with 157,125 units of both generations.[1][2][3] The Model S was the best selling plug-in car in the U.S. for three consecutive years, from 2015 to 2017,[13][14] and the Model 3 also has topped sales for three years running, from 2018 to 2020.[2][15][16]

The Energy Improvement and Extension Act of 2008 and later the Inflation Reduction Act granted federal tax credits for new qualified plug-in electric vehicles, worth up to US$7,500.[17][18] As of 2014, Washington, D.C. and 37 states and had established incentives and tax or fee exemptions for BEVs and PHEVs, or utility-rate breaks, and other non-monetary incentives such as free parking and high-occupancy vehicle lane access.[19]

Overview by state

Articles about plug-in electric vehicles in individual states:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Government support

In his 2011 State of the Union address, President Barack Obama set the goal for the U.S. to become the first country to have one million electric vehicles on the road by 2015.[20] This goal was established based on forecasts made by the U.S. Department of Energy (DoE), using production capacity of PEV models announced to enter the U.S. market through 2015. The DoE estimated a cumulative production of 1,222,200 PEVS by 2015, and was based on manufacturer announcements and media reports accounting production goals for the Fisker Karma, Fisker Nina, Ford Transit Connect, Ford Focus Electric, Chevrolet Volt, Nissan Leaf, Smith Newton, Tesla Roadster, Tesla Model S and Th!nk City.[21]

Considering that actual PEV sales were lower than initially expected, as of early 2013, several industry observers have concluded that this goal was unattainable.[22][23][24][25] Obama's goal was achieved only in September 2018.[26][27]

In 2008, San Francisco Mayor Gavin Newsom, San Jose Mayor Chuck Reed and Oakland Mayor Ron Dellums announced a nine-step policy plan for transforming the Bay Area into the "Electric Vehicle (EV) Capital of the U.S.".[28] Other local and state governments have also expressed interest in electric cars.[29]

Governor of California Jerry Brown issued an executive order in March 2012 that established the goal of getting 1.5 million zero-emission vehicles (ZEVs) on California roads by 2025.[30][31][32]

American Recovery and Reinvestment Act

President Barack Obama pledged US$2.4 billion in federal grants to support the development of next-generation electric vehicles and batteries.[33][34] $1.5 billion in grants to U.S. based manufacturers to produce highly efficient batteries and their components; up to $500 million in grants to U.S. based manufacturers to produce other components needed for electric vehicles, such as electric motors and other components; and up to $400 million to demonstrate and evaluate plug-in hybrids and other electric infrastructure concepts—like truck stop charging station, electric rail, and training for technicians to build and repair electric vehicles (green collar jobs).[35]

In March 2009, as part of the American Recovery and Reinvestment Act, the U.S. Department of Energy announced the release of two competitive solicitations for up to $2 billion in federal funding for competitively awarded cost-shared agreements for manufacturing of advanced batteries and related drive components as well as up to $400 million for transportation electrification demonstration and deployment projects. This initiative aimed to help meet President Barack Obama's goal of putting one million plug-in electric vehicles on the road by 2015.[20][36]

Tax credits

New plug-in electric vehicles

Federal incentives

First the Energy Improvement and Extension Act of 2008, and later the American Clean Energy and Security Act of 2009 (ACES) granted tax credits for new qualified plug-in electric drive motor vehicles.[17] The American Recovery and Reinvestment Act of 2009 (ARRA) also authorized federal tax credits for converted plug-ins, though the credit is lower than for new plug-in electric vehicle (PEV).[37]

As defined by the 2009 ACES Act, a PEV is a vehicle which draws propulsion energy from a traction battery with at least 5 kwh of capacity and uses an offboard source of energy to recharge such battery.[17] The tax credit for new plug-in electric vehicles is worth US$2,500 plus US$417 for each kilowatt-hour of battery capacity over 5 kwh, and the portion of the credit determined by battery capacity cannot exceed US$5,000. Therefore, the total amount of the credit, between US$2,500 and US$7,500, will vary depending on the capacity of the battery (4 to 16 kWh) used to power the vehicles.[38]

The qualified plug-in electric vehicle credit phases out for a plug-in manufacturer over the one-year period beginning with the second calendar quarter after the calendar quarter in which at least 200,000 qualifying plug-in vehicles from that manufacturer have been sold for use in the U.S. Cumulative sales started counting sales after December 31, 2009. After reaching the cap, qualifying PEVs for one quarter still earn the full credit, the second quarter after that quarter plug-in vehicles are eligible for 50% of the credit for six months, then 25% of the credit for another six months and finally the credit is phased out.[17] Both the Nissan Leaf electric vehicle and the Chevrolet Volt plug-in hybrid, launched in December 2010, are eligible for the maximum $7,500 tax credit.[39] The Toyota Prius Plug-in Hybrid, released in January 2012, is eligible for a US$2,500 tax credit due to its smaller battery capacity of 5.2 kWh.[40] All Tesla cars and the Chevrolet Bolts and BMW i3 BEV are eligible for the US$7,500 tax credit.

A 2016 study conducted by researchers from the University of California, Davis found that the federal tax credit was the reason behind more than 30% of the plug-in electric sales. The impact of the federal tax incentive is higher among owners of the Nissan Leaf, with up to 49% of sales attributable to the federal incentive. The study, based on a stated preference survey of more than 2,882 plug in vehicle owners in 11 states, also found that the federal tax credit shifts buyers from internal combustion engine vehicles to plug-in vehicles and advances the purchase timing of new vehicles by a year or more.[41]

In July 2018, Tesla Inc. was the first plug-in manufacturer to pass 200,000 sales and the full tax credit will be available until the end 2018, with the phase out beginning in January 2019.[42] General Motors combined sales of plug-in electric vehicles passed 200,000 units in November 2018. The full tax credit will be available until the end of March 2019 and thereafter reduces gradually until it is completely phase out beginning on April 1, 2020.[43][44] In order of cumulative sales, as of November 2018, Nissan has delivered 126,875 units, Ford 111,715, Toyota 93,011 and the BMW Group 79,679 plug-in electric cars.[45]

A January 2024 study from the University of Michigan Center for Sustainable Systems found that the $7,500 tax credit and other federal incentives were needed to make BEVs cost competitive with ICEVs in many locations and for many vehicle classes.[46]

State incentives

As of November 2014, 37 states and Washington, D.C. have established incentives and tax or fee exemptions for BEVs and PHEVs, or utility-rate breaks, and other non-monetary incentives such as free parking and high-occupancy vehicle lane access regardless of the number of occupants.[19] In California, for example, the Clean Vehicle Rebate Project (CVRP) was established to promote the production and use of zero-emission vehicles (ZEVs). Eligible vehicles include only new Air Resources Board-certified or approved zero-emission or plug-in hybrid electric vehicles.[47] Among the eligible vehicles are neighborhood electric vehicles, battery electric, plug-in hybrid electric, and fuel cell vehicles including cars, trucks, medium- and heavy-duty commercial vehicles, and zero-emission motorcycles. Vehicles must be purchased or leased on or after March 15, 2010. Rebates initially of up to US$5,000 per light-duty vehicle, and later lowered to up to US$2,500, are available for individuals and business owners who purchase or lease new eligible vehicles. Certain zero-emission commercial vehicles are also eligible for rebates up to US$20,000.[48][49][50] California's zero-emission (ZEV) regulations are anticipated to result in 1.5 million electric vehicles on the road by 2025 ( i.e., 15% sales of total states in 2025); moreover, California's mixed incentives means to reach 40% of electric vehicle sales in the entire U.S.[38]

Electric vehicle purchases made in the U.S. are eligible for $2,500 to $7,500, depending on the make and model of the vehicle, in federal tax credit.[51]

The following table summarizes some of the state incentives:[52][53]

| State | Amount of incentive |

Type of PEV/vehicle |

Type of incentive |

Carpool lane access |

Comments |

|---|---|---|---|---|---|

| Arizona | BEVs | Lower vehicle licensing tax | Yes | Eligibility for PHEVs depends on the extent to which the vehicle is powered by electricity. Maximum of $75 available to individuals for installation of EV charging outlets. | |

| California | up to $2,500 | BEVs | Purchase rebate | Yes | Free access to HOVs through January 1, 2019, which also benefits natural gas vehicles and hydrogen fuel cell vehicles.[55] The amount of subsidies received is limited by annual income as of March 29, 2016. |

| up to $2,500 | PHEVs | Purchase rebate | Yes | PHEV free access to HOV lanes until January 1, 2019.[56] The cap was originally for the first 70,000 applicants. The cap was later raised to 85,000 and the limit was reached in December 2015. Per SB-838, and effective as of September 13, 2016, the Green Clean Air Vehicle Decal limit imposed by AB 95 has been removed.[57] | |

| up to $1,500 | Electric motorcycles and NEVs |

Purchase rebate | Yes | All motorcycles have free access to HOV lanes. | |

| Colorado | $5,000 | BEVs and PHEVs |

Income tax credit | No | $5,000 refundable tax credit on all new BEVs and PHEVs. Cost of vehicle cannot exceed $80,000.[58] |

| Connecticut | up to $3,000 | BEVs, PHEV | Rebate | No | CHEAPR provides up to $3,000 for fuel cell EV, EV or plug-in hybrid electric vehicle. Rebates are offered on a first-come, first-served basis. |

| Delaware | up to $2,200 | EV | Rebate | No | Customers with at a grid-integrated EV may qualify to receive kilowatt-hour credits for energy discharged to the grid from the EV's battery at the same rate that the customer pays to charge the battery. |

| District of Columbia | BEVs and PHEVs |

Excise tax exemption and reduced registration fees | No | A tax credit up to 50% of the equipment costs for the purchase and installation of electric vehicle charging station, up to $1,000 per residential install. | |

| Florida | BEVs and PHEVs |

Yes | Access to HOVs through January 1, 2018 if displaying the EV decal. Florida Statutes protects consumers from additional charges from insurance providers from insuring electric vehicles. | ||

| Georgia | $0 | ZEVs | Income tax credit | Yes | Tax credit of 20% of the cost of a zero emission vehicle up to $5,000 purchased before July 1, 2015. Plug-in hybrids were not eligible for this incentive.[59] The incentive removal reduced sales of small EVs but had little effect on large EVs.[60] |

| up to $2,500 | Alternative fuel conversion |

Income tax credit | Yes | Tax credit of 10% of the conversion cost for a vehicle converted to run solely on an alternative fuel and meets the standards for a low-emission vehicle up to $2,500.[59] | |

| up to $20,000 | Commercial AFVs | Income tax credit | Yes | Tax credit for new commercial medium-duty or heavy-duty AFVs or Medium-duty hybrid EVs that operate using at least 90% alternative fuel, expires June 30, 2017.[61] | |

| Hawaii | BEVs and PHEVs |

Parking | Yes | Carpool lane access and reduced rates for electric vehicle charging. EVs with EV license plates are exempt from certain parking fees charged by any non-federal government authorities. | |

| Idaho | BEVs, PHEV | Inspection Exemption | No | EVs are exempt from state motor vehicle inspection and maintenance programs. | |

| Illinois | BEVs, PHEVs and conversions |

Inspection Exemption | No | Vehicles powered exclusively by electricity are exempt from state motor vehicle emissions inspections; this was suspended in March 2015. Covered 80% of cost premium or electric conversion price, up to $4,000. | |

| Indiana | up to $1,650 | BEVs, PHEV | No | Credit to install residential charging station and free plug-in electric vehicle charging during off-peak hours until Jan. 31, 2017. | |

| Louisiana | up to $3,000 | BEVs, PHEVs and conversions |

Inspection Exemption | No | Tax credit of 50% of cost premium for BEV/PHEV purchase, 50% of conversion cost, or a tax credit worth 10% of the cost of a new BEV/PHEV vehicle up to $3,000. This same credit also applies to charge station costs. |

| Maryland | up to $3,000 | BEVs and PHEVs |

Yes[62] | Plug-in EVs are eligible for an excise tax credit until July 1, 2020.[63] The state also offers a US$900 rebate for buying and installation of wall connectors for individuals; US$5,000 for business, or state or local governments; and US$7,000 for retail service station dealers.[64] | |

| Massachusetts | up to $1,000 | BEVs and PHEVs |

Purchase rebate | Up to $1,000 rebate for purchasing PEVs, funds are limited.[65] | |

| Michigan | BEVs, PHEV | Inspection exemption | No | Alternative fuel vehicles are exempt from emissions inspection requirements. Indiana Michigan Power, Consumers Energy and DTE Energy offer other incentives. | |

| Minnesota | BEVs, PHEV | No | All public utilities must file a tariff that allows a customer to purchase electricity solely for the purpose of recharging an electric vehicle. The tariff must include either a time-of-day or off-peak rate. | ||

| Mississippi | BEVs, PHEV | Income tax credit | No | 0% interest loans for public school districts and municipalities to purchase alternative fuel school buses and other motor vehicles, convert school buses and other motor vehicles to use alternative fuels, purchase alternative fuel equipment, and install fueling stations. | |

| Missouri | up to $15,000 | BEVs, PHEV | No | Tax credit for the cost of installing a qualified alternative fueling station, until Jan. 1, 2018, and are exempt from state emissions inspection requirements. | |

| Montana | up to $500 | Alternative fuel conversion | Income tax credit | No | Credit only available for conversion costs up to $500 or 50% of conversion cost. Includes electric car conversion.[66] |

| Nebraska | BEVs, PHEV | Loans | No | Provides low-cost loans for purchase of EVs, the conversion of conventional vehicles to operate on alternative fuels, and the construction or purchase of a fueling station or equipment. | |

| Nevada | BEVs, PHEV | Yes | Exempt from emissions testing requirements and local public metered parking areas must have areas for EVs to park without paying a fee. Carpool lane access and reduced rates for electric vehicle charging. | ||

| New Hampshire | N/A | N/A | N/A | N/A | N/A |

| New Jersey | up to $5000 | BEVs, PHEV | Purchase rebate + sales tax exemption | Yes | Sales tax exemption for qualifying BEVs only, not PHEVs. The Turnpike offers a 10% discount from off-peak toll rates on the New Jersey Turnpike for vehicles that have a fuel economy of 45 miles per gallon or higher. |

| New York | BEVs, PHEVs and HEVs |

Yes | Plug-in electric vehicles and hybrid electric vehicles with a combined fuel economy rating of at least 45 mpg‑US (5.2 L/100 km; 54 mpg‑imp) and that also meet the California Air Resources Board SULEV emissions standard, are eligible for the Clean Pass Program. Eligible vehicles which display the Clean Pass vehicle sticker are allowed to use the Long Island Expressway HOV lanes, regardless of the number of occupants.[67] Drivers of qualified vehicles may also receive a 10% discount on established E-ZPass accounts with proof of registration.[68] A tax credit for 50 percent of the cost, up to $5,000, for the purchase and installation of a charging station until Dec. 31, 2017. | ||

| North Carolina | PHEV | Yes | Qualified PEVs are exempt from state emissions inspection requirements. | ||

| Ohio | EV | Yes | Vehicles powered exclusively by electricity, propane, or natural gas are exempt from state vehicle emissions inspections after receiving a one-time verification inspection. | ||

| Oklahoma | 75% cost | Income tax credit | No | A tax credit is available for up to 75 percent of the cost of installing charging stations. | |

| Oregon | BEVs | Income tax credit | No | A tax credit for 25% of charging station costs, up to $750 (more for commercial use). | |

| Pennsylvania | up to $2,000 | BEVs and PHEVs |

Purchase rebate | No | 250 rebates to assist with the purchase of new EVs. As of June 24, 2015, 193 rebates remain.[69] |

| Rhode Island | PHEV | Inspection exemption | No | Vehicles powered exclusively by electricity are exempt from state emissions control inspections. | |

| South Carolina | up to $1,500 | BEVs and PHEVs |

Income tax credit | No | Tax credit equaling 20% of federal credit for PHEVs and BEVs. |

| Tennessee | BEVs and PHEVs |

Rebate | Yes | Rebate is limited. HOV lane access. | |

| Texas | No | No credits exist as of 2020. | |||

| Utah | up to $1,500 | Conversions only | Income tax credit | Yes | Credit to convert a vehicle to run on propane, natural gas, or electricity. Allowed carpool lane access. |

| up to $1,500 | BEVs and PHEVs |

Income tax credit | Yes | Until Dec. 31, 2016 | |

| Virginia | BEVs and PHEVs |

No | Alternative fuel and hybrid electric vehicles are exempt from emissions testing. | ||

| Washington | BEVs | Sales tax | No | Beginning on July 1, 2016, a sales tax exemption applies to the first US$32,000 of the selling price of a qualifying new plug-in electric car, which translates into a tax savings between US$2,600 and US$3,100 for plug-in car buyers depending on where the dealer is located within the state, as the sales tax varies by county. The incentive applies towards the purchase or lease of a new car all-electric vehicle, or a plug-in hybrid with at least 30 mi (48 km) of all-electric range – such as the Chevrolet Volt and the BMW i3 REx. The new law also raises the previous purchase price cap to US$42,500, which will allow buyers of the Chevrolet Bolt EV, the next generation Nissan Leaf, and the Tesla Model 3 – all with 200 mi (320 km) of electric range – to be eligible for the incentive.[70][71] The tax exemption was brought back starting August 1, 2019 with a US$45,000 price cap for the first US$25,000 of the selling price. This ramps down to US$20,000 on August 1, 2021, and US$15,000 on August 1, 2023, phasing out completely after July 31, 2025.[72][73] | |

| Washington, D.C. | BEVs | Sales tax | No | Vehicles that operate exclusively on electricity, hydrogen, natural gas, or propane are exempt from excise taxes. |

New proposals

Several separate initiatives have been pursued unsuccessfully at the federal level since 2011 to transform the tax credit into an instant cash rebate. The objective of these initiatives is to make new qualifying plug-in electric cars more accessible to buyers by making the incentive more effective. The rebate would be available at the point of sale allowing consumers to avoid a wait of up to a year to apply the tax credit against income tax returns.[74][75][76]

In March 2014, the Obama administration included a provision in the FY 2015 Budget to increase the maximum tax credit for plug-in electric vehicles and other advanced vehicles from US$7,500 to US$10,000. The new maximum tax credit would not apply to luxury vehicles with a sales price of over US$45,000, such as the Tesla Model S and the Cadillac ELR, which would be capped at US$7,500.[77] In November 2017, House Republicans proposed scrapping the US$7,500 tax credit as part of a sweeping tax overhaul.[78]

Charging equipment

Until 2010 there was a federal tax credit equal to 50% of the cost to buy and install a home-based charging station with a maximum credit of US$2,000 for each station. Businesses qualified for tax credits up to US$50,000 for larger installations.[39][79] These credits expired on December 31, 2010, but were extended through 2013 with a reduced tax credit equal to 30% with a maximum credit of up to US$1,000 for each station for individuals and up to US$30,000 for commercial buyers.[80][81] In 2016, the Obama administration and several stake holders announced $4.5 billion in loan guarantees for public charge stations, along with other initiatives.[82]

EV Everywhere Challenge

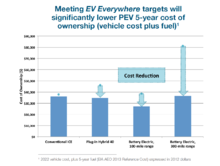

On March 7, 2012, President Barack Obama launched the EV Everywhere Challenge as part of the U.S. Department of Energy's Clean Energy Grand Challenges, which seeks to solve some of the U.S. biggest energy challenges and make clean energy technologies affordable and accessible to the vast majority of American households and businesses. The EV Everywhere Challenge has the goal of advancing electric vehicle technologies to have the country, by 2022, to produce a five-passenger electric vehicle that would provide both a payback time of less than five years and the ability to be recharged quickly enough to provide enough range for the typical American driver.[83][84]

In January 2013 the Department of Energy (DoE) published the "EV Everywhere Grand Challenge Blueprint," which set the technical targets of the PEV program in four areas: battery research and development; electric drive system research and development; vehicle lightweighting; and advanced climate control technologies. The DoE set several specific goals, established in consultation with stakeholders.[85] The key goals to be met over the next five years to make plug-in electric vehicles competitive with conventional fossil fuel vehicles are:

- Cutting battery costs from their current US$500/kWh to US$125/kWh

- Eliminating almost 30% of vehicle weight through lightweighting

- Reducing the cost of electric drive systems from US$30/kW to US$8/kW

The DoE aim is to level the purchase plus operating (fuel) cost of an all-electric vehicle with a 280 mi (450 km) range with the costs of an internal combustion engine (ICE) vehicle of similar size. The DoE expects than even before the latter goals are met, the 5-year cost of ownership of most plug-in hybrid electric vehicles and of all-electric vehicles with shorter ranges, such as 100 mi (160 km), will be comparable to the same cost of ICE vehicles of similar size.[85][86]

In order to achieve these goals, the DoE is providing up to US$120 million over the next five years to fund the new Joint Center for Energy Storage Research (JCESR), a research center led by the Argonne National Laboratory in Chicago.[86][87] An initial progress report for the initiative was released in January 2014. Four results of the first year of the initiative were reported:[88]

- DOE research and development reduced the cost of electric drive vehicle batteries to US$325/ kWhr, 50% lower than 2010 costs.

- In the first year of the Workplace Charging Challenge, more than 50 U.S. employers joined the Challenge and pledged to provide charging access at more than 150 sites.

- DOE investments in EV Everywhere technology topped US$225 million in 2013, addressing key barriers to achieving the Grand Challenge.

- Consumer acceptance of electric vehicles grew: 97,000 plug-in electric vehicles were sold in 2013, nearly doubling 2012 sales.

- Workplace Charging Challenge

In January 2013, during the Washington Auto Show, Secretary of Energy Steven Chu announced an initiative to expand the EV Everywhere program with the "Workplace Charging Challenge." This initiative is a plan to install more electric vehicle charging stations in workplace parking lots. There are 21 founding partners and ambassadors for the program, including Ford, Chrysler, General Motors, Nissan, Tesla Motors, 3M, Google, Verizon, Duke Energy, General Electric, San Diego Gas & Electric, Siemens, Plug In America, and the Rocky Mountain Institute. The initiative's target is to increase the number of U.S. employers offering workplace charging by tenfold in the next five years. Initially, the DoE will not provide funding for this initiative.[89][90]

U.S. military

The U.S. Army announced in 2009 that it will lease 4,000 Neighborhood Electric Vehicles (NEVs) within three years. The Army plans to use NEVs at its bases for transporting people around the base, as well as for security patrols and maintenance and delivery services. The Army accepted its first six NEVs at Virginia's Fort Myer in March 2009 and will lease a total of 600 NEVs through the rest of the year, followed by the leasing of 1,600 NEVs for each of the following two years.[91]

U.S. Air Force officials announced, in August 2011, a plan to establish Los Angeles Air Force Base, California, as the first federal facility to replace 100% of its general purpose fleet with plug-in electric vehicles. As part of the program, all Air Force-owned and -leased general purpose fleet vehicles on the base will be replaced with PEVs. There are approximately 40 eligible vehicles, ranging from passenger sedans to two-ton trucks and shuttle buses. The replacement PEVs include all-electric, plug-in hybrids, and extended-range electric vehicles. Electrification of Los Angeles AFB's general purpose fleet is the first step in a Department of Defense effort to establish strategies for large-scale integration of PEVs.[92]

By May 2013, it was announced that, as part of a test program created in January 2013, 500 plug-in electric vehicles with vehicle-to-grid (V2G) technology would be in use at six military bases, purchased using an investment of $20 million. If the program succeeds, there will be 3,000 V2G vehicles in 30 bases.[93]

The National Defense Authorization Act passed in December, 2022, requires new non-combat military vehicles be electric by 2035.[94]

Safety laws

Due to the low noise typical of electric vehicles at low speeds, the National Highway Traffic Safety Administration ruled that all hybrids and EVs must emit artificial noise when idling, accelerating to 19 mph (30 km/h) or going in reverse by September 2019.[95][96]

U.S. commitments to the 2015 Paris Agreement

As a signatory party to the 2015 Paris Climate Agreement, the United States government committed to reduce its greenhouse gas emissions, among others, from the transportation sector.[97] Already in 2015, the Federal government had set targets to reduce its own carbon footprint 30% by 2025, and acquire 20% of all new passenger vehicles as zero emission (all-electric of fuel cell) or plug-in hybrid by 2020, and 50% by 2025.[97][98] These goals are part of the U.S. nationally determined contributions (NDCs) to achieve the worldwide emissions reduction goal set by the Paris Agreement.[97][99]

On June 1, 2017, President Donald Trump announced that the U.S. would cease all participation in the 2015 Paris Agreement on climate change mitigation.[100]

On November 3, 2020, then President-elect Joe Biden announced that his administration will reverse President Donald Trump's United States withdrawal from the Paris Agreement by re-entering the United States into the Paris Agreement to continue to reiterated commitment in the agreement and move forward with the proposed Green New Deal legislation, to fight the global climate change problems as soon as Biden is inaugurated into office on January 20, 2021, succeeding then-outgoing Trump as President of the United States. Joe Biden also criticized Trump for withdrawing and ceasing all US participation from the UN Paris Agreement on June 1, 2017, and as Biden said that withdrawing from the UN Paris Agreement is a huge mistake. Joe Biden promises to introduce and transition to more energy-efficient buildings, increase generation of renewable energy by gradually moving away from the dependence of fracking and fossil fuels as energy sources in the US, transition the entire government fleet to 100% all-electric vehicles by the 2030s, and introduce more electric vehicles to all 50 US states.

As of 5 August 2021, the Biden administration expects 60% of all new vehicles sold in the US to be 100% all-electric vehicles by 2030 and expects new car sales of fossil fuel vehicles to be banned in the US by the 2035 timeframe, as a result of Joe Biden signing an executive order mandating that 60% of all new car sales in the US must be 100% all-electric vehicles by 2030. The Biden government plans to accomplish these goals by more incentivizing of electric vehicles, impose hefty government taxes and restrictions on internal-combustion engine vehicles, increase fuel prices for refilling up fossil-fuel vehicles, implement congestion-charge pricing zones, and impose more tougher and stringent Corporate Average Fuel Economy standards and US Environmental Protection Agency regulations on automotive emissions standards, which are all climate change and green energy provisions included in the Build Back Better Act.[101][102][103]

In December 2021, the Biden administration imposed Executive Order 14057, which is a nationwide federal government mandate that will ban new fossil fuel vehicles from all 50 US States, Washington, D.C., and all US Territories by 2035 to push the transition to electric vehicles. The order will ban new car sales of fossil-fuel powered government-owned vehicles by 2027, new fossil-fuel powered buses by 2030, and both new fossil-fuel powered privately-owned vehicles and new fossil-fuel powered commercial-owned vehicles by 2035. The US Environmental Protection Agency also unveiled stringent automotive emissions and fuel economy requirements for internal combustion engine-powered vehicles that will become mandatory on all new US-market ICE-powered vehicles starting for the 2023 model year. The standards will also get tougher and more stringent for the 2026, 2029, and 2032 model years. The new regulations will also require at least 20% of all-new vehicles sold in the United States to be 100% all-electric vehicles by 2026, followed by requiring at least 60% of all-new vehicles sold in the United States to be 100% all-electric vehicles by 2030, and finally followed by requiring 100% of all-new vehicles sold in the United States to be 100% all-electric vehicles by 2035.[104][105]

Tariffs on imports

Operating costs

The costs to operate an EV in the US are typically lower or much lower than gasoline cars, as they require much less fuel.[106] Maintenance costs are also lower, at roughly $0.04 per mile. Over the typical lifetime of a car, this sums to a difference about $8,000 compared to a gasoline car.[107]

Air pollution and greenhouse gas emissions

Electric cars, as well as plug-in hybrids operating in all-electric mode, emit no harmful tailpipe pollutants from the onboard source of power, such as particulates (soot), volatile organic compounds, hydrocarbons, carbon monoxide, ozone, lead, and various oxides of nitrogen. The clean air benefit is usually local because, depending on the source of the electricity used to recharge the batteries, air pollutant emissions are shifted to the location of the generation plants.[108] In a similar manner, plug-in electric vehicles operating in all-electric mode do not emit greenhouse gases from the onboard source of power, but from the point of view of a well-to-wheel assessment, the extent of the benefit also depends on the fuel and technology used for electricity generation. From the perspective of a full life cycle analysis, the electricity used to recharge the batteries must be generated from renewable or clean sources such as wind, solar, hydroelectric, or nuclear power for PEVs to have almost none or zero well-to-wheel emissions.[108][109]

EPA estimates

The following table compares tailpipe and upstream CO2 emissions estimated by the U.S. Environmental Protection Agency for all series production model year 2014 plug-in electric vehicles available in the U.S. market. Total emissions include the emissions associated with the production and distribution of electricity used to charge the vehicle, and for plug-in hybrid electric vehicles, it also includes emissions associated with tailpipe emissions produced from the internal combustion engine. These figures were published by the EPA in October 2014 in its annual report "Light-Duty Automotive Technology, Carbon Dioxide Emissions, and Fuel Economy Trends." All emissions are estimated considering average real world city and highway operation based on the EPA 5-cycle label methodology, using a weighted 55% city and 45% highway driving.[110]

For purposes of an accurate estimation of emissions, the analysis took into consideration the differences in operation between plug-in hybrids. Some, like the Chevrolet Volt, can operate in all-electric mode without using gasoline, and others operate in a blended mode like the Toyota Prius PHV, which uses both energy stored in the battery and energy from the gasoline tank to propel the vehicle, but that can deliver substantial all-electric driving in blended mode. In addition, since the all-electric range of plug-in hybrids depends on the size of the battery pack, the analysis introduced a utility factor as a projection of the share of miles that will be driven using electricity by an average driver, for both, electric only and blended EV modes. Since all-electric cars do not produce tailpipe emissions, the utility factor applies only to plug-in hybrids. The following table shows the overall fuel economy expressed in terms of miles per gallon gasoline equivalent (mpg-e) and the utility factor for the ten MY2014 plug-in hybrids available in the U.S. market, and EPA's best estimate of the CO2 tailpipe emissions produced by these PHEVs.[110]

In order to account for the upstream CO2 emissions associated with the production and distribution of electricity, and since electricity production in the United States varies significantly from region to region, the EPA considered three scenarios/ranges with the low end scenario corresponding to the California powerplant emissions factor, the middle of the range represented by the national average powerplant emissions factor, and the upper end of the range corresponding to the powerplant emissions factor for the Rocky Mountains. The EPA estimates that the electricity GHG emission factors for various regions of the country vary from 346 g CO2/kWh in California to 986 g CO2/kWh in the Rockies, with a national average of 648 g CO2/kWh.[110]

| Vehicle | Overall fuel economy (mpg-e) |

Utility factor(2) (share EV miles) |

Tailpipe CO2 (g/mi) |

Tailpipe + total upstream CO2 | ||

|---|---|---|---|---|---|---|

| Low (g/mi) |

Avg (g/mi) |

High (g/mi) | ||||

| BMW i3 | 124 | 1 | 0 | 93 | 175 | 266 |

| Chevrolet Spark EV | 119 | 1 | 0 | 97 | 181 | 276 |

| Honda Fit EV | 118 | 1 | 0 | 99 | 185 | 281 |

| Fiat 500e | 116 | 1 | 0 | 101 | 189 | 288 |

| Nissan Leaf | 114 | 1 | 0 | 104 | 194 | 296 |

| Mitsubishi i | 112 | 1 | 0 | 104 | 195 | 296 |

| Smart electric drive | 107 | 1 | 0 | 109 | 204 | 311 |

| Ford Focus Electric | 105 | 1 | 0 | 111 | 208 | 316 |

| Tesla Model S (60 kWh) | 95 | 1 | 0 | 122 | 229 | 348 |

| Tesla Model S (85 kWh) | 89 | 1 | 0 | 131 | 246 | 374 |

| BMW i3 REx(3) | 88 | 0.83 | 40 | 134 | 207 | 288 |

| Mercedes-Benz B-Class ED | 84 | 1 | 0 | 138 | 259 | 394 |

| Toyota RAV4 EV | 76 | 1 | 0 | 153 | 287 | 436 |

| BYD e6 | 63 | 1 | 0 | 187 | 350 | 532 |

| Chevrolet Volt | 62 | 0.66 | 81 | 180 | 249 | 326 |

| Toyota Prius Plug-in Hybrid | 58 | 0.29 | 133 | 195 | 221 | 249 |

| Honda Accord Plug-in Hybrid | 57 | 0.33 | 130 | 196 | 225 | 257 |

| Cadillac ELR | 54 | 0.65 | 91 | 206 | 286 | 377 |

| Ford C-Max Energi | 51 | 0.45 | 129 | 219 | 269 | 326 |

| Ford Fusion Energi | 51 | 0.45 | 129 | 219 | 269 | 326 |

| BMW i8 | 37 | 0.37 | 198 | 303 | 351 | 404 |

| Porsche Panamera S E-Hybrid | 31 | 0.39 | 206 | 328 | 389 | 457 |

| McLaren P1 | 17 | 0.43 | 463 | 617 | 650 | 687 |

| Average gasoline car | 24.2 | 0 | 367 | 400 | 400 | 400 |

| Notes: (1) Based on 45% highway and 55% city driving. (2) The utility factor represents, on average, the percentage of miles that will be driven using electricity (in electric only and blended modes) by an average driver. (3) The EPA classifies the i3 REx as a series plug-in hybrid[111][110] | ||||||

Union of Concerned Scientists

2012 study

The Union of Concerned Scientists (UCS) published a study in 2012 that assessed average greenhouse gas emissions in the U.S. resulting from charging plug-in car batteries from the perspective of the full life-cycle (well-to-wheel analysis) and according to fuel and technology used to generate electric power by region. The study used the Nissan Leaf all-electric car to establish the analysis baseline, and electric-utility emissions are based on EPA's 2009 estimates. The UCS study expressed the results in terms of miles per gallon instead of the conventional unit of grams of greenhouse gases or carbon dioxide equivalent emissions per year in order to make the results more friendly for consumers. The study found that in areas where electricity is generated from natural gas, nuclear, hydroelectric or renewable sources, the potential of plug-in electric cars to reduce greenhouse emissions is significant. On the other hand, in regions where a high proportion of power is generated from coal, hybrid electric cars produce less CO2-e equivalent emissions than plug-in electric cars, and the best fuel efficient gasoline-powered subcompact car produces slightly less emissions than a PEV. In the worst-case scenario, the study estimated that for a region where all energy is generated from coal, a plug-in electric car would emit greenhouse gas emissions equivalent to a gasoline car rated at a combined city/highway driving fuel economy of 30 mpg‑US (7.8 L/100 km; 36 mpg‑imp). In contrast, in a region that is completely reliant on natural gas, the PEV would be equivalent to a gasoline-powered car rated at 50 mpg‑US (4.7 L/100 km; 60 mpg‑imp).[112][113]

The study concluded that for 45% of the U.S. population, a plug-in electric car will generate lower CO2 equivalent emissions than a gasoline-powered car capable of combined 50 mpg‑US (4.7 L/100 km; 60 mpg‑imp), such as the Toyota Prius and the Prius c. The study also found that for 37% of the population, the electric car emissions will fall in the range of a gasoline-powered car rated at a combined fuel economy of 41 to 50 mpg‑US (5.7 to 4.7 L/100 km; 49 to 60 mpg‑imp), such as the Honda Civic Hybrid and the Lexus CT200h. Only 18% of the population lives in areas where the power-supply is more dependent on burning carbon, and the greenhouse gas emissions will be equivalent to a car rated at a combined fuel economy of 31 to 40 mpg‑US (7.6 to 5.9 L/100 km; 37 to 48 mpg‑imp), such as the Chevrolet Cruze and Ford Focus.[113][114][115] The study found that there are no regions in the U.S. where plug-in electric cars will have higher greenhouse gas emissions than the average new compact gasoline engine automobile, and the area with the dirtiest power supply produces CO2 emissions equivalent to a gasoline-powered car rated at 33 mpg‑US (7.1 L/100 km).[112]

The following table shows a representative sample of cities within each of the three categories of emissions intensity used in the UCS study, showing the corresponding miles per gallon equivalent for each city as compared to the greenhouse gas emissions of a gasoline-powered car:

| Regional comparison of full life cycle assessment of greenhouse gas emissions resulting from charging plug-in electric vehicles expressed in terms of miles per gallon of a gasoline-powered car with equivalent emissions[112][114][115] | |||||

|---|---|---|---|---|---|

| Rating scale by emissions intensity expressed as miles per gallon |

City | PEV well-to-wheels carbon dioxide equivalent (CO2-e) emissions per year expressed as mpg US |

Percent reduction in CO2-e emissions compared with 27 mpg US average new compact car |

Combined EPA's rated fuel economy and GHG emissions for reference gasoline-powered car[116] | |

| Best LowestCO2-e emissions equivalent to over 50 mpg‑US (4.7 L/100 km) |

Juneau, Alaska | 112 mpg‑US (2.10 L/100 km) | 315% | 2012 Toyota Prius/Prius c 50 mpg‑US (4.7 L/100 km) | |

| San Francisco | 79 mpg‑US (3.0 L/100 km) | 193% | |||

| New York City | 74 mpg‑US (3.2 L/100 km) | 174% | |||

| Portland, Oregon | 73 mpg‑US (3.2 L/100 km) | 170% | Greenhouse gas emissions (grams/mile) | ||

| Boston | 67 mpg‑US (3.5 L/100 km) | 148% | Tailpipe CO2 | Upstream GHG | |

| Washington, D.C. | 58 mpg‑US (4.1 L/100 km) | 115% | 178 g/mi (111 g/km) | 44 g/mi (27 g/km) | |

| Better Moderate CO2-e emissions equivalent to between 41 mpg‑US (5.7 L/100 km) and 50 mpg‑US (4.7 L/100 km) |

Phoenix, Arizona | 48 mpg‑US (4.9 L/100 km) | 78% | 2012 Honda Civic Hybrid 44 mpg‑US (5.3 L/100 km) | |

| Miami | 47 mpg‑US (5.0 L/100 km) | 74% | |||

| Houston | 46 mpg‑US (5.1 L/100 km) | 70% | Greenhouse gas emissions (grams/mile) | ||

| Columbus, Ohio | 41 mpg‑US (5.7 L/100 km) | 52% | Tailpipe CO2 | Upstream GHG | |

| Atlanta | 41 mpg‑US (5.7 L/100 km) | 52% | 202 g/mi (125 g/km) | 50 g/mi (31 g/km) | |

| Good Highest CO2-e emissions equivalent to between 31 mpg‑US (7.6 L/100 km) and 40 mpg‑US (5.9 L/100 km) |

Detroit | 38 mpg‑US (6.2 L/100 km) | 41% | 2012 Chevrolet Cruze 30 mpg‑US (7.8 L/100 km) | |

| Des Moines, Iowa | 37 mpg‑US (6.4 L/100 km) | 37% | |||

| St. Louis, Missouri | 36 mpg‑US (6.5 L/100 km) | 33% | Greenhouse gas emissions (grams/mile) | ||

| Wichita, Kansas | 35 mpg‑US (6.7 L/100 km) | 30% | Tailpipe CO2 | Upstream GHG | |

| Denver | 33 mpg‑US (7.1 L/100 km) | 22% | 296 g/mi (184 g/km) | 73 g/mi (45 g/km) | |

| Source: Union of Concerned Scientists, 2012.[112] Notes: The Nissan Leaf is the baseline car for the assessment, with an energy consumption rated by EPA at 34 kWh/100 mi or 99 miles per gallon gasoline equivalent (2.4 L/100 km) combined. The ratings are based on a region's mix of electricity sources and its average emissions intensity over the course of a year. In practice the electricity grid is very dynamic, with the mix of power plants constantly changing in response to hourly, daily and seasonal electricity demand, and availability of electricity resources. | |||||

2014 update

In September 2014 the UCS published an updated analysis of its 2012 report. The 2014 analysis found that 60% of Americans, up from 45% in 2009, live in regions where an all-electric car produce fewer CO2 equivalent emissions per mile than the most efficient hybrid. The UCS study found several reasons for the improvement. First, electric utilities have adopted cleaner sources of electricity to their mix between the two analysis. The 2014 study used electric-utility emissions based on EPA's 2010 estimates, but since coal use nationwide is down by about 5% from 2010 to 2014, actual efficiency in 2014 is expected to be better than estimated in the UCS study. Second, electric vehicles have become more efficient, as the average model year 2013 all-electric vehicle used 0.325 kWh/mile, representing a 5% improvement over 2011 models. The Nissan Leaf, used as the reference model for the baseline of the 2012 study, was upgraded in model year 2013 to achieve a rating of 0.30 kWh/mile, a 12% improvement over the 2011 model year model rating of 0.34 kWh/mile. Also, some new models are cleaner than the average, such as the BMW i3, which is rated at 0.27 kWh by the EPA. An i3 charged with power from the Midwest grid would be as clean as a gasoline-powered car with about 50 mpg‑US (4.7 L/100 km), up from 39 mpg‑US (6.0 L/100 km) for the average electric car in the 2012 study. In states with a cleaner mix generation, the gains were larger. The average all-electric car in California went up to 95 mpg‑US (2.5 L/100 km) equivalent from 78 mpg‑US (3.0 L/100 km) in the 2012 study. States with dirtier generation that rely heavily on coal still lag, such as Colorado, where the average BEV only achieves the same emissions as a 34 mpg‑US (6.9 L/100 km; 41 mpg‑imp) gasoline-powered car. The author of the 2014 analysis noted that the benefits are not distributed evenly across the U.S. because electric car adoption is concentrated in the states with cleaner power.[117][118]

2015 study

| External media | |

|---|---|

| Images | |

| Video | |

In November 2015 the Union of Concerned Scientists published a new report comparing two battery electric vehicles (BEVs) with similar gasoline vehicles by examining their global warming emissions over their full life-cycle, cradle-to-grave analysis. The two BEVs modeled, midsize and full-size, are based on the two most popular BEV models sold in the United States in 2015, the Nissan Leaf and the Tesla Model S. The study found that all-electric cars representative of those sold today, on average produce less than half the global warming emissions of comparable gasoline-powered vehicles, despite taken into account the higher emissions associated with BEV manufacturing. Considering the regions where the two most popular electric cars are being sold, excess manufacturing emissions are offset within 6 to 16 months of average driving. The study also concluded that driving an average EV results in lower global warming emissions than driving a gasoline car that gets 50 mpg‑US (4.7 L/100 km) in regions covering two-thirds of the U.S. population, up from 45% in 2009. Based on where EVs are being sold in the United States in 2015, the average EV produces global warming emissions equal to a gasoline vehicle with a 68 mpg‑US (3.5 L/100 km) fuel economy rating. The authors identified two main reason for the fact that EV-related emissions have become even lower in many parts of the country since the first study was conducted in 2012. Electricity generation has been getting cleaner, as coal-fired generation has declined while lower-carbon alternatives have increased. In addition, electric cars are becoming more efficient. For example, the Nissan Leaf and the Chevrolet Volt, have undergone improvements to increase their efficiencies compared to the original models launched in 2010, and other even more efficient BEV models, such as the most lightweight and efficient BMW i3, have entered the market.[119]

Marginal emissions

When computing the short-term impact of additional EVs on the grid, the additional greenhouse gas emissions are better estimated using not the average emissions of the grid at a location, but instead the additional (marginal) emissions caused by the extra demand.[120] The former approach does not take into account the generation mix within interconnected electricity markets and shifting load profiles throughout the day.[121][122] An analysis by three economist affiliated with the National Bureau of Economic Research (NBER), published in 2014, developed a methodology to estimate marginal emissions of electricity demand that vary by location and time of day across the United States. The study used emissions and consumption data for 2007 through 2009, and used the specifications for the Chevrolet Volt (all-electric range of 35 mi (56 km)). The analysis found that marginal emission rates are more than three times as large in the Upper Midwest compared to the Western U.S., and within regions, rates for some hours of the day are more than twice those for others.[122] Applying the results of the marginal analysis to plug-in electric vehicles, the NBER researchers found that the emissions of charging PEVs vary by region and hours of the day. In some regions, such as the Western U.S. and Texas, CO2 emissions per mile from driving PEVs are less than those from driving a hybrid car. However, in other regions, such as the Upper Midwest, charging during the recommended hours of midnight to 4 a.m. implies that PEVs generate more emissions per mile than the average car currently on the road. The results show a fundamental tension between electricity load management and environmental goals as the hours when electricity is the least expensive to produce tend to be the hours with the greatest emissions. This occurs because coal-fired units, which have higher emission rates, are most commonly used to meet base-level and off-peak electricity demand; while natural gas units, which have relatively low emissions rates, are often brought online to meet peak demand. This pattern of fuel shifting explains why emission rates tend to be higher at night and lower during periods of peak demand in the morning and evening.[122]

Environmental footprint

In February 2014, the Automotive Science Group (ASG) published the result of a study conducted to assess the life-cycle of over 1,300 automobiles across nine categories sold in North America. The study found that among advanced automotive technologies, the Nissan Leaf holds the smallest life-cycle environmental footprint of any model year 2014 automobile available in the North American market with minimum four-person occupancy. The study concluded that the increased environmental impacts of manufacturing the battery electric technology is more than offset with increased environmental performance during operational life. For the assessment, the study used the average electricity mix of the U.S. grid in 2014.[123] In the 2014 mid-size cars category, the Leaf also ranked as the best all-around performance, best environmental and best social performance. The Ford Focus Electric, within the 2014 compact cars category, ranked as the best all-around performance, best environmental and best social performance. The Tesla Model S ranked as the best environmental performance in the 2014 full-size cars category.[124]

Charging infrastructure

As of February 2020, the United States had 84,866 charging points across the country, up from 19,472 in December 2013.[125][126] California led with 26,219 stations, followed by New York with 4,541. There were 592 CHAdeMO quick charging stations across the country by April 2014.[127]

Among the charging networks are Electrify America, launched in May 2019 as part of VW's settlement for the Dieselgate emissions scandal, and the Electric Highway Coalition, announced in March 2021, a group of six major power utilities in the Southeast and Midwest installing EV charging across 16 states, with the first chargers targeted for opening in 2022.[128][129]

| Top fifteen states ranked by number of public charging points available in the United States (as of February 2020)[125] | |||

|---|---|---|---|

| State | Number of points |

State | Number of points |

| California | 26,219 | Colorado | 2,440 |

| New York | 4,541 | Massachusetts | 2,376 |

| Texas | 4,497 | Missouri | 2,029 |

| Florida | 4,096 | Illinois | 1,933 |

| Washington | 3,016 | Maryland | 1,919 |

| Georgia | 2,910 | Total U.S. | 84,866 |

| Note: The U.S. DoE Alternative Fuels Data Center counts electric charging units or points, or EVSE, as one for each outlet available, and does not include residential electric charging infrastructure. Number of public charging points as of 2 February 2020.[125] | |||

Car2Go made San Diego the only North American city with an all-electric carsharing fleet when it launched service in 2011. As of March 2016, the carsharing service has 40,000 members and 400 all-electric Smart EDs in operation. However, due to lack of enough charging infrastructure Car2Go decided to replace all of its all-electric car fleet with gasoline-powered cars starting on 1 May 2016. When the carsharing service started Car2Go expected 1,000 charging stations to be deployed around the city, but only 400 were in place by early 2016. As a result, an average of 20% of the carsharing fleet is unavailable at any given time because the cars are either being charged or because they don't have enough electricity in them to be driven. Also, many of the company's San Diego members say they often worry their Car2Go will run out of charge before they finish their trip.[130] Car2Go merged with ReachNow into Share Now, which closed its North American operations in February 2020.

Charging stations by state

EV Charging by State

| State | Number of public EV charging stations[131] |

|---|---|

| Alabama | 1,372 |

| Alaska | 227 |

| Arizona | 3,320 |

| Arkansas | 1,040 |

| California | 38,660 |

| Colorado | 4,675 |

| Connecticut | 1,872 |

| Delaware | 525 |

| District of Columbia | 921 |

| Florida | 8,942 |

| Georgia | 5,165 |

| Hawaii | 804 |

| Idaho | 751 |

| Illinois | 5,131 |

| Indiana | 1,870 |

| Iowa | 1,387 |

| Kansas | 1,397 |

| Kentucky | 1,271 |

| Louisiana | 937 |

| Maine | 1,177 |

| Maryland | 4,130 |

| Massachusetts | 5,176 |

| Michigan | 9,366 |

| Minnesota | 3,240 |

| Mississippi | 529 |

| Missouri | 2,491 |

| Montana | 928 |

| Nebraska | 985 |

| Nevada | 1,845 |

| New Hampshire | 639 |

| New Jersey | 3,689 |

| New Mexico | 1,089 |

| New York | 10,101 |

| North Carolina | 4,336 |

| North Dakota | 407 |

| Ohio | 3,973 |

| Oklahoma | 1,200 |

| Oregon | 3,224 |

| Pennsylvania | 4,398 |

| Rhode Island | 497 |

| South Carolina | 1,780 |

| South Dakota | 586 |

| Tennessee | 2,420 |

| Texas | 9,541 |

| Utah | 2,655 |

| Vermont | 1,123 |

| Virginia | 4,115 |

| Washington | 5,777 |

| West Virginia | 601 |

| Wisconsin | 2,359 |

| Wyoming | 431 |

Plug-in Electric Vehicle Readiness Index

Researchers from the Indiana University School of Public and Environmental Affairs developed an index that identifies and ranks the municipal plug-in electric vehicle readiness ("PEV readiness"). The evaluation ranked the U.S. 25 largest cities by population along with five other large cities that have been included in other major PEV studies. The rankings also included the largest cities in states that joined California zero-emissions vehicle goal. A total of 36 major U.S. cities were included in the study. The evaluation found that Portland, Oregon ranks at the top of the list of major American cities that are the most ready to accommodate plug-in electric vehicles.[132]

Readiness is the degree to which adoption of electric vehicles is supported, as reflected in the presence of various types of policy instruments, infrastructure development, municipal investments in PEV technology, and participation in relevant stakeholder coalitions. The study also compares cities within states that participate in the Zero Emission Vehicle program, with those that do not, with the objective to understand whether participation in that program has a meaningful impact on PEV readiness.[132][133]

In order to accelerate the adoption of plug-in electric vehicles (PEV), many municipalities, along with their parent states, offer a variety of benefits to owners and operators of PEVs to make PEV adoption easier and more affordable. All six cities in the top of the ranking offer purchase incentives for PEVs and charging equipment. Four of the six offer time-of-use electricity rates, which makes overnight charging more affordable. The top-ranking cities also score well in categories such as public charging station density, special parking privileges, access to high occupancy vehicle (HOV) lanes, and streamlined processes for installing charging equipment. Those services and incentives are largely absent from the bottom six cities.[132]

The following is the full ranking of the 36 U.S. cities in 25 states included in the evaluation of PEV readiness:

Issues

Weight of EVs

EVs tend to be heavier than internal combustion vehicles[134] due to the large batteries. This means higher emissions as well as increasing the cost of road maintenance.

The heavy weights of electric vehicles also arises safety issues - larger cars cause more damage to pedestrians, people on bikes, and lighter vehicles.[135]

Solving the wrong problem

While EVs may directly help decrease carbon emissions, they do not solve any of the other problems with cars.[136]

They still create congestion, use up valuable city space, require large parking lots, promote suburban sprawl, and create many other issues within cities.[137]

For these other issues, it is important to have a strong public transport system, which can reduce the need for cars in the first place, and can lead to a better quality of life for the majority.[138]

Markets and sales

National market

As of December 2023, cumulative sales of highway legal plug-in electric cars in the U.S. totaled 4,684,128 units since 2010.[4] Sales totaled 1,402,371 units in 2023, with a market share of 9.1%. This was the first time the American market surpassed the 1 million sales mark.[4] As of December 2019, the American stock represented 20% of the global plug-in car fleet in use, down from about 40% in 2014.[5][141] Sales in the American market are led by California with 1 million plug-in cars registered by November 2021, 46% of the national stock.[12]

As of December 2014, the United States had the world's largest stock of light-duty plug-in electric vehicles, and led annual plug-in car sales in calendar year 2014.[142][143] By May 2016, the European stock of light-duty had surpassed the U.S.[144] By the end of September 2016, the Chinese stock of plug-in passenger cars reached the level of the American plug-in stock,[145] and by November 2016, China's cumulative total plug-in passenger vehicles sales had surpassed those of Europe, allowing China to become the market with the world's largest stock of light-duty plug-in electric vehicles.[142][146] China also surpassed both the U.S. and Europe in terms of annual sales of light-duty plug-in electric vehicles since 2015.[147]

National sales increased from 17,800 units delivered in 2011 to 53,200 during 2012, and reached 97,100 in 2013, up 83% from the previous year.[153] During 2014 plug-in electric car sales totaled 123,347 units, up 27.0% from 2013, and fell to 114,248 units in 2015, down 7.4% from 2014.[7] A total of 157,181 plug-in cars were sold in 2016, up 37.6% from 2015,[154] rose to 199,818 in 2017, and achieved a record sales volume of 361,307 units in 2018.[15] Sales declined in 2019 to 329,528 units.[16]

The market share of plug-in electric passenger cars increased from 0.14% in 2011 to 0.37% in 2012, 0.62% in 2013, and reached 0.75% of new car sales in 2014.[6][155][7] As plug-in car sales slowed down during the 2015, the segment's market share fell to 0.66% of new car sales,[7][156] then increased to 0.90% in 2016.[14] The market share passed the 1% mark for the first time in 2017 (1.13%).[8] Then in 2018 the take-rate rose to 2.1%,[9] but declined to 1.9% in 2019.[10]

In July 2016, the Volt became the first plug-in vehicle in the American market to achieve the 100,000 unit sales milestone.[159] Leaf sales achieved the 100,000 unit milestone in October 2016, becoming the first all-electric vehicle in the country to pass that mark.[160] The Model S achieved the mark of 100,000 sales in the U.S. in June 2017, launched in June 2012, the Model S hit this milestone quicker than both the Volt and the Leaf.[161][162] Launched in July 2017, the Tesla Model 3 reached the 100,000 unit milestone in November 2018, hitting this milestone quicker than any previous model sold in the U.S.[163]

As of December 2018, the Chevrolet Volt plug-in hybrid listed as the all-time best selling plug-in electric car with 152,144 units of both generations.[164] The Model S was the best selling plug-in car in the U.S. for three consecutive years, from 2015 to 2017,[13] and the Model 3 topped sales in 2018 and 2019.[15][16] The Model 3 surpassed in 2019 the discontinued Chevrolet Volt to become the all-time best selling plug-in car in U.S. history, with an estimated 300,471 units delivered since inception, followed by the Tesla Model S all-electric car with about 157,992, and the Chevrolet Volt with 157,054.[1]

Sales by powertrain

As of December 2014, cumulative sales of plug-in electric vehicles in the U.S. since December 2010 were led by plug-in hybrids, with 150,946 units sold representing 52.7% of all plug-in car sales, while 135,444 all-electric cars (47.3%) had been delivered to retail customers.[139] During 2015, the all-electric segment grew much faster, with a total of 72,303 all-electric cars sold, up 6.6% year-on-year, while plug-in hybrid were down 22.4% year-on-year, with 42,959 units sold.[7] These results reversed the trend, and as of December 2015, a total of 206,508 all-electric cars and 193,904 plug-in hybrids have been sold since 2010, with all-electrics now representing 51.6% of cumulative sales.[139][168] The lead of battery electric cars continued in 2016, with 84,246 all-electrics sold, up 18.4% from 2015, representing 53.6% of the plug-in segment 2016 sales, while sales of plug-in hybrids totaled 72,935 unis, up 69.1% from 2015.[154] As of August 2016, the distribution of cumulative sales since 2010 between these two technologies is 52.8% all-electrics and 47.2% plug-in hybrids.[169]

Sales growth

Sales of series production plug-in cars during its first two years in the U.S. market were lower than the initial expectations.[22][23][25][172] Cumulative plug-in electric car sales since 2008 reached the 250,000 units in August 2014,[173] 500,000 in August 2016,[169] and the one million goal was achieved in September 2018.[26][27]

According to the U.S. Department of Energy, combined sales of plug-in hybrids and battery electric cars are climbing more rapidly and outselling by more than double sales of hybrid-electric vehicles over their respective 24 month introductory periods, as shown in the graph at the right.[85]

A more detailed analysis by the Office of Energy Efficiency and Renewable Energy over the same two-year introductory periods found that except for the initial months in the market, monthly sales of the Volt and the Leaf have been higher than the Prius HEV, and the Prius PHEV has outsold the regular Prius during its 8 months in the market. Over the first 24 months from introduction, the Prius HEV achieved monthly sales of over 1,700 in month 18, the Leaf achieved about 1,700 units in month 7, the Prius PHEV achieved nearly 1,900 sales in month 8, and the Volt achieved more than 2,900 sales in month 23.[174] A 2016 analysis by the Consumer Federation of America (CFA) found that 5 years after its introduction, sales of plug-in electric cars in the U.S. continued to outsell conventional hybrids. The analysis considered sales between January 2011 and December 2015.[175]

An analysis by Scientific American found a similar trend at the international level when considering the global top selling PEVs over a 36-month introductory period. Monthly sales of the Volt, Prius PHV and Leaf are performing better than the conventional Prius during their respective introductory periods, with the exception of the Mitsubishi i-MiEV, which has been outsold most of the time by the Prius HEV over their 36-month introductory periods.[176]

Key market features

According to Edmunds.com, leasing of plug-in cars instead of purchasing is dominant in the American market, with leasing accounting for 51% of all new all-electric cars and 73% of plug-in hybrids, compared with just 32% of gasoline-powered cars in 2016.[177]

As of 2016, the market of used plug-in electric cars is concentrated in California, the state with the biggest pool of used plug-in vehicles, especially all-electrics, followed by Colorado, Florida, Georgia, New York, Oregon and Texas. With the exception of used Teslas, all models depreciate more rapidly than conventionally powered cars and trucks. For all-electric cars depreciation varies from 60% to 75% in three years. In contrast, most conventionally powered vehicles in the same period depreciate between 45% and 50%. The Tesla Model S is more like conventional cars, with three-year depreciation of about 40%. And plug-in hybrids depreciate less than all-electric cars but still depreciate faster than conventionally powered cars.[177]

Researchers from the University of California, Davis, conducted a study to identify the factors influencing the decision to adopt high-end battery electric vehicles (BEV), such as the Tesla Model S, as these vehicles are remarkably different from mainstream BEVs. Based on a questionnaire responded by 539 high-end adopters and in-depth interviews with 33 adopters, the 2016 study found that "environmental, performance, and technological motivations are reasons for adoption; the new technology brings a new segment of buyers into the market; and financial purchase incentives are not important in the consumer’s decision to adopt a high-end BEV."[178]

Car dealers' reluctance to sell

With the exception of Tesla Motors, almost all new cars in the United States are sold through dealerships, so they play a crucial role in the sales of electric vehicles, and negative attitudes can hinder early adoption of plug-in electric vehicles.[179][180] Dealers decide which cars they want to stock, and a salesperson can have a big impact on how someone feels about a prospective purchase. Sales people have ample knowledge of internal combustion cars while they do not have time to learn about a technology that represents a fraction of overall sales.[179] As with any new technology, and in the particular case of advanced technology vehicles, retailers are central to ensuring that buyers, especially those switching to a new technology, have the information and support they need to gain the full benefits of adopting this new technology.[180] A 2016 study indicated that 60% of Americans were not aware of electric cars.[181]

There are several reasons for the reluctance of some dealers to sell plug-in electric vehicles. PEVs do not offer car dealers the same profits as gasoline-powered cars. Plug-in electric vehicles take more time to sell because of the explaining required, which hurts overall sales and sales people commissions. Electric vehicles also may require less maintenance, resulting in loss of service revenue, and thus undermining the biggest source of dealer profits, their service departments. According to the National Automobile Dealers Association (NADS), dealers on average make three times as much profit from service as they do from new car sales. However, a NADS spokesman said there was not sufficient data to prove that electric cars would require less maintenance.[179] According to the New York Times, BMW and Nissan are among the companies whose dealers tend to be more enthusiastic and informed, but only about 10% of dealers are knowledgeable on the new technology.[179]

A study conducted at the Institute of Transportation Studies (ITS), at the University of California, Davis (UC Davis) published in 2014 found that many car dealers are less than enthusiastic about plug-in vehicles. ITS conducted 43 interviews with six automakers and 20 new car dealers selling plug-in vehicles in California's major metro markets. The study also analyzed national and state-level J.D. Power 2013 Sales Satisfaction Index (SSI) study data on customer satisfaction with new car dealerships and Tesla retail stores. The researchers found that buyers of plug-in electric vehicles were significantly less satisfied and rated the dealer purchase experience much lower than buyers of non-premium conventional cars, while Tesla Motors earned industry-high scores. According to the findings, plug-in buyers expect more from dealers than conventional buyers, including product knowledge and support that extends beyond traditional offerings.[180][182]

In 2014 Consumer Reports published results from a survey conducted with 19 secret shoppers that went to 85 dealerships in four states, making anonymous visits between December 2013 and March 2014. The secret shoppers asked a number of specific questions about cars to test the salespeople's knowledge about electric cars. The consumer magazine decided to conduct the survey after several consumers who wanted to buy a plug-in car reported to the organization that some dealerships were steering them toward gasoline-powered models. The survey found that not all sales people seemed enthusiastic about making PEV sales; a few outright discouraged it, and even one dealer was reluctant to even show a plug-in model despite having one in stock. And many sales people seemed not to have a good understanding of electric-car tax breaks and other incentives or of charging needs and costs. Consumer Reports also found that when it came to answering basic questions, sales people at Chevrolet, Ford, and Nissan dealerships tended to be better informed than those at Honda and Toyota. The survey found that most of the Toyota dealerships visited recommended against buying a Prius Plug-in and suggested buying a standard Prius hybrid instead. Overall, the secret shoppers reported that only 13 dealers "discouraged sale of EV," with seven of them being in New York. However, at 35 of the 85 dealerships visited, the secret shoppers said sales people recommended buying a gasoline-powered car instead.[183]

The ITS-Davis study also found that a small but influential minority of dealers have introduced new approaches to better meet the needs of plug-in customers. Examples include marketing carpool lane stickers, enrolling buyers in charging networks, and preparing incentive paperwork for customers. Some dealers assign seasoned sales people as plug-in experts, many of whom drive plug-ins themselves to learn and be familiar with the technology and relate the cars' benefits to potential buyers. The study concluded also that carmakers could do much more to support dealers selling PEVs.[180]

Regional markets

Concentration relative to population

As of July 2016, the U.S. average concentration was 1.51 plug-in cars registered per 1,000 people, while California's concentration was 5.83 registrations per 1,000 people. At the time, only Norway exceeded California's plug-in concentration per capita, by 3.69 times.[184][185] As of December 2017, the average national ownership per capita rose to 2.21 plug-ins per 1,000 people.[186]

In 2017 eight states had more than two plug-in vehicles registered per 1,000 people, of which, three are located in the West Coast. California had the highest concentration with 8.64 plug-ins per 1,000 people. Hawaii ranked second (5.12) followed by Washington (4.06), Oregon (3.84) Vermont (3.73), Colorado (2.33), Arizona (2.29), and Maryland (2.03).[186] Mississippi (0.20), Arkansas (0.28), West Virginia (0.30), Louisiana (0.31), Wyoming (0.37), and North Dakota (0.39) had the lowest concentration of plug-in cars in 2017.[186] In terms of growth from 2016 to 2017 for plug-in vehicle registrations per capita, five states had growth rates of 50% or higher: Vermont (56.4%) Maryland (54.2%), Massachusetts (52.5%), New Hampshire (50.2%), and Alaska (50.0%). The U.S. average growth rate from 2016 to 2017 was 30.2%.[187]

Market share by city and state

The following table summarizes the ten states and metropolitan areas leading all-electric car adoption in terms of their market share of new light-vehicle registrations or sales during 2013 and 2014.

| Rank 2014(1) |

State[188] | Market share(2) 2014 CYTD(1) |

Rank 2013 |

State[188] | Market share(2) 2013 |

Rank | Metro area[189] | Market share 2013-2014(3) | |

| 1 | Georgia | 1.60% | 1 | Washington | 1.40% | 1 | San Francisco-Oakland-San Jose | 3.33% | |

| 2 | California | 1.41% | 2 | California | 1.28% | 2 | Atlanta | 2.15% | |

| 3 | Washington | 1.13% | 3 | Hawaii | 1.21% | 3 | Seattle-Tacoma | 1.83% | |

| 4 | Hawaii | 1.04% | 4 | Georgia | 0.94% | 4 | Honolulu | 1.71% | |

| 5 | Oregon | 0.67% | 5 | Oregon | 0.89% | 5 | Monterey-Salinas | 1.51% | |

| 6 | Utah | 0.31% | 6 | Washington, D.C. | 0.52% | 6 | San Diego | 1.34 % | |

| 7 | Colorado | 0.27% | 7 | Colorado | 0.33% | 7 | Santa Barbara-Santa Maria-San Luis Obispo | 1.29% | |

| 8 | Arizona | 0.20% | 8 | Utah | 0.31% | 8 | Portland | 1.25% | |

| 9 | Tennessee | 0.19% | 9 | Tennessee | 0.28% | 9 | Los Angeles | 1.08% | |

| 10 | Connecticut | 0.19% | 10 | Illinois | 0.25% | 10 | Eugene | 0.86% | |

| U.S. average | 0.32%[188] | 0.38%[190] | |||||||

| Notes: (1) CYTD: current year-to-date sales as of 30 June 2014 (2) New all-electric vehicle (BEV) registrations as % of total new registrations of light-vehicles only. (3) Sales of new all-electric vehicles as % of total new light-vehicle sales between April 2013 and March 2014. | |||||||||

A total of 52% of American plug-in electric car registrations from January to May 2013 were concentrated in five metropolitan areas: San Francisco (19.5%), Los Angeles (15.4%), Seattle (8.0%), New York (4.6%) and Atlanta (4.4%).[191][192] From January to July 2013, the three cities with the highest all-electric car registrations were all located in California, Atherton and Los Altos in the Silicon Valley, followed by Santa Monica, located in Los Angeles County.[193][194]

Sales by model

As of December 2018, there were 43 highway legal plug-in cars available in the American market for retail sales, 15 all-electric cars and 28 plug-in hybrids,[195] plus several models of electric motorcycles, utility vans and neighborhood electric vehicles (NEVs). As of November 2018, sales were concentrated to a few models, with the top 10 best selling plug-in cars accounting for about 84% of total sales during the first eleven months of 2018.[196] Car manufacturers are offering plug-in electric cars in the U.S. for retail customers under 21 brands or marques: Audi, BMW, Cadillac, Chevrolet, Chrysler, Fiat, Ford, Honda, Hyundai, Jaguar, Kia, Mercedes-Benz, MINI, Mitsubishi, Nissan, Porsche, Smart, Tesla, Toyota, Volkswagen, and Volvo.[197]

As of September 2016, only the Chevrolet Volt, Nissan Leaf, Tesla's Model S and Model X, BMW i3, Mitsubishi i, Porsche Panamera S E-Hybrid, Cadillac ELR, and Ford's C-Max and Fusion Energi plug-in hybrids were available nationwide. Several models, such as the Toyota RAV4, Fiat 500e, Honda Fit EV, and Chevrolet Spark EV, are compliance cars sold in limited markets, mainly California, available in order to raise an automaker's fleet average fuel economy to satisfy regulator requirements.[198][199][200][201]

As of November 2018, the top selling plug-in car manufacturers in the American market are Tesla with about 269,000 units delivered, GM with 203,941, Nissan with 126,875 units, Ford with 111,715, Toyota with 93,011 and the BMW Group with 79,679 plug-in electric cars.[45]

Top selling models

The Nissan Leaf was the U.S. top selling plug-in car in 2011 (9,674), and the Chevrolet Volt topped sales in 2012 (23,461).[6] Again in 2013, sales were led by the Chevrolet Volt with 23,094 units, followed by the Nissan Leaf with 22,610 cars, and the Tesla Model S with about 18,000 units.[202] In 2013 the Model S was the top selling car in the American full-size luxury sedan category, ahead of the Mercedes-Benz S-Class (13,303), the top selling car in the category in 2012.[202] In 2014 the Leaf took the sales lead, with 30,200 units sold, with the Volt ranking second with 18,805, followed by the Model S with 16,689 units.[7]

The Tesla Model S, with 25,202 units delivered, was the top selling plug-in car in 2015, followed by the Nissan Leaf with 17,269 units, and the Volt with 15,393.[7] Again in 2016, the Model S was the best selling plug-in car with about 29,156 units delivered, followed by the Volt with 24,739, and the Model X with about 18,028.[14] For the third consecutive year, the Tesla Model S was the top selling plug-in car with about 26,500 units sold in 2017, followed by the Chevrolet Bolt (23,297), Tesla Model X (~21,700).[8][203]